Final close: Sponsors fight through buyout fundraising drought

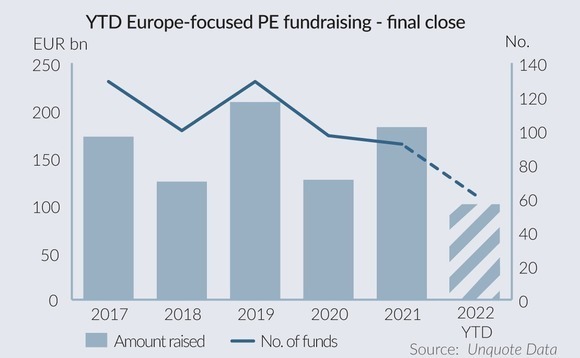

Sponsors investing in Europe are set for a poor year for fundraising with just EUR 100.5bn committed so far, Unquote Data shows.

Many big names remain on the dusty road, although a handful, including Nordic Capital, have managed to reach their destinations.

Buyout funds are extremely unlikely to surpass 2021's record year of fundraising, with the capital committed remaining 53.2% behind last year's total, according to the data.

This is likely to be the lowest total amount raised since 2018 when sponsors raised EUR 133.7bn. Funds are struggling to close due to tough competition, which isn't helped by the so-called denominator effect. This involves falling prices in one segment of a portfolio pulling down the whole portfolio.

The number of funds is likely to fall significantly below last year's, with just 62 closed this year, but some established and specialised investors have convinced limited partners (LPs) to keep hiking to the end.

Nordic Capital held a final close for Fund XI at EUR 9bn in October, nearly 50% larger than its 2020 predecessor. Other large closes include Advent International's USD 25bn GPE X and ICG's EUR 8.1bn ICG Europe Fund VIII. Sector specialist funds too have thrived with healthcare funds on track for a record year of fundraising.

Nordic Capital closed its fund in nine months in what it admitted has been "some of the most challenging fundraising conditions in private equity history".

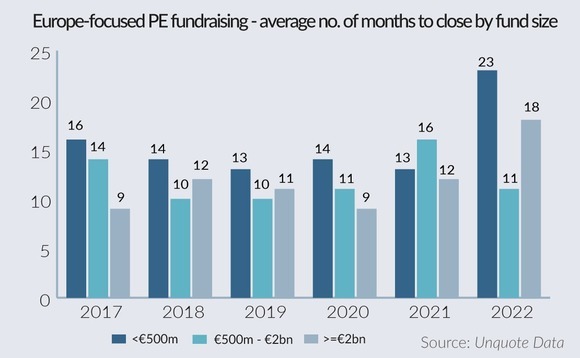

Where sponsors have over the past few years been on the road for about a year before a final close, funds this year took on average 18 months to reach that milestone.

Established firms are faring the best, with funds larger than EUR 2bn this year taking 11 months versus 16 months for 2021. However, many big-name general partners (GPs) have been on the road for more than a year so far.

Low- and mid-market sponsors are facing tough conditions on their hikes, with funds at less than EUR 500m taking 23 months to close compared to 14 months historically.

As well as the denominator effect, mega-cap fundraises have overtaken other travellers. Sponsors are also coming back to the market every two years or so to raise more.

Final curtain

There are a handful of other large-cap GPs that look close to closing their latest flagship funds, including CVC Capital Partners IX, which has a EUR 20bn target, and Eighth Cinven Fund, with a USD 12bn target.

However, the drought is expected to cause a shake-out, especially among JAMBOs (just another mid-market buyout group). Some funds like Silverfleet have already admitted defeat and retired from the road.

Even so, there are paths forward for funds struggling to raise. One option being discussed by sponsors is attaching a lucrative GP stake investment as a staple to a large commitment to incentivize LPs.

Another option is to up the skin-in-the-game: Nordic increased its GP commitment in its latest fund. Others, where possible, could just sit, wait it out and reemerge from the ashes, said one lower-market UK-based GP.

Market consolidation has been touted, as the easiest way to grow is to be consumed, said one private equity lawyer, as large managers pick off the best for new strategies and specializations. However, long hikes in tough conditions aren't for everyone and other funds are likely to give up in the months ahead.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds