DACH

Sponsors brave the storm amid drop in financial services M&A

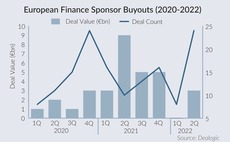

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

DPE-backed building service provider Calvias files for insolvency

GP had placed the technical building service provider up for sale in late 2021, according to Mergermarket

COI Partners launches DACH growth fund with EUR 120m target

GP's first institutional fund will invest on a 50:50 basis alongside the sponsor's own deal-by-deal vehicles

Crédit Mutuel Equity boosts German deal hunt with new appointments

Crédit Mutuel Group-backed evergreen fund to plough “several hundred million euros” in DACH

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

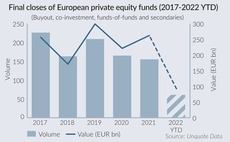

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Motive raises USD 2.54bn across Fund 2 and co-investment vehicles

GP's USD 1.8bn Fund 2 is 3.7x the size of its predecessor and expects to make 15-18 deals

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller

Mubadala leads equity raise in Wefox's USD 400m Series D

Berlin-based insurtech platform valued at USD 4.5bn in equity and debt round

Partners Group hires ZF's Scheider as head of private equity

Car parts maker CEO will join the Swiss GP’s headquarters in Baar-Zug in early 2023

Equistone weighs auction for United Initiators

Evercore is advising on upcoming sale of the Germany-based specialty chemicals supplier

Novum places MMC Studios in continuation fund

New vehicle will allow German GP to complete wind-down of Fund I; DWS Private Equity added as anchor investor

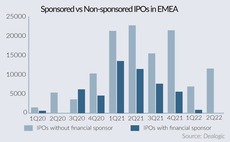

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Levine Leichtman Capital inches closer to first German deal

Planned transaction follows US investor's opening of Frankfurt office in January

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

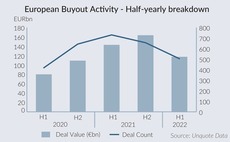

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Levine Leichtman Capital appoints head of Europe

Promotion of Josh Kaufman comes as GP looks to grow its nascent German investment capabilities

Earlybird names three new Digital West partners

Andre Retterath and Paul Klemm are existing team members, while Vincenzo Narciso joins from Px3 Partners

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments

Acton Capital holds Fund VI first close, expands investment team

VC firm has hired Sophie Ahrens-Gruber in Munich and appointed Hannes Gruber as partner in Vancouver

Gyrus buys majority stake in Katalist Group

GP and Katalist's founders are planning bolt-ons for the food and pharma supply chain software firm

Unigestion gears up for Climate Impact Fund

GP in initial discussions with existing investors for first climate-focused fund

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

LGT Capital closes first dedicated impact fund on USD 550m

Crown Impact will make co-investments, as well as primary and secondary fund investments