DACH

Adveq to open London office

Swiss fund-of-funds Adveq is in the process of setting up a new office in London.

Cinven buys Ceramtec for €1.5bn

Cinven has acquired Ceramtec, the Germany-based ceramics subsidiary of NYSE-listed chemicals and advanced materials company Rockwood Holdings, for €1.5bn.

EQT and GIC opt for Springer Science IPO

EQT and GIC's plans for a potential trade sale of German media publisher Springer Science to BC Partners have definitely been scrapped as the owners firmly focus on a listing.

Harris Williams opens Frankfurt office

Mid-market investment bank Harris Williams & Co has opened a second European office in Frankfurt.

European Capital exits MTH

European Capital has sold German company Metall Technologie Holding GmbH (MTH) to LOI Thermprocess GmbH, reaping a 1.6x multiple on its original investment.

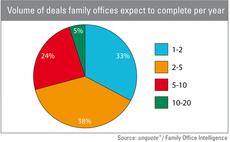

Family offices seek surge in deal origination

Family offices

Uniqa to sell $665m private equity portfolio

Austrian insurance company Uniqa Versicherungen is planning to offload $665m of private equity positions ahead of Solvency II.

EQT's Springer Science still in dual-track process

BC Partners is reportedly left as the sole bidder for EQT portfolio company Springer Science, which announced IPO plans last week.

German VCs saying: "Ich bin ein Berliner"

For firms looking to set up shop in Germany, selecting the right city can prove challenging. Amy King argues the case for heading to Berlin

PDV Inter-Media Venture et al. back PressMatrix

PDV Inter-Media Venture has joined existing backers in a €2.5m series-A funding round for PressMatrix, a German technical service provider for tablets and mobile devices.

Deutsche Annington to list ahead of Terra Firma fundraise

Deutsche Annington, the German real estate group backed by Terra Firma, has confirmed it will list on the Frankfurt Stock Exchange this year.

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of ТЃ935m.

Neomed and Defi back CHF 1.3m round for Diagnoplex

Neomed and Defi Gestion have taken part in a CHF 1.3m funding round for Diagnoplex SA, a Swiss developer of diagnostics for colon cancer.

GCP in £6m Fishawack bolt-on

Fishawack, a medical communications agency backed by Growth Capital Partners (GCP), has acquired Switzerland-based Archimed Medical Communications for ТЃ6m.

EQT's Springer Science aiming to raise €760m in IPO

Springer Science, a German publishing business owned by EQT, has confirmed plans to list on the Frankfurt Stock Exchange before the summer break.

Bill Gates, Tenaya et al. invest $35m in ResearchGate

Bill Gates, Tenaya Capital and other investors have completed a series-A financing round for ResearchGate, a professional network for scientists.

Prime Ventures backs AppLift with €10m investment

Prime Ventures has invested €10m in a series-A funding round for a Berlin-based marketing platform for mobile games, AppLift GmbH.

EQT's Springer Science to announce IPO plans

Springer Science, a German publishing business owned by EQT, could announce plans for an IPO within the next two weeks, according to reports.

Zurmont Madison et al. take majority stake in Schaetti

Zurmont Madison and co-investors have acquired a majority stake in Swiss technology company Schaetti Holding AG.

EdRip takes minority stake in MCI

Edmond de Rothschild Investment Partners (EdRip) has taken part in a capital increase for Swiss events organisation business MCI.

Target Partners exits JouleX in $107m trade sale

Target Partners has sold its stake in IT energy management company JouleX Inc to US high-tech business Cisco.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

EU postpones Solvency II rules on pensions

The European Commission has postponed a bid to apply Solvency II style rules to pension funds as part of the revised IORP Directive.

Beechbrook mezzanine fund hits €67m first close

Northern European investor Beechbrook Capital has raised тЌ67m for its latest mezzanine fund at first close.