DACH

Lanxess joins HTGF II investors

German chemicals company Lanxess has invested a low seven-figure sum in venture investor High-Tech Gründerfonds' second fund, raising the vehicle's total commitments to €301.5m.

Halder appoints new executive chairman

Halder Beteiligungsberatung has appointed Hanns Ostmeier as executive chairman in the firm's Frankfurt office.

DPE closes fund II on €350m

Deutsche Private Equity (DPE) has closed its second fund on €350m, alongside a feeder fund.

TPG mulls listing of Grohe Group

TPG-backed Grohe Group, a supplier of bathroom and kitchen products, is considering an IPO after a lengthy nine-year holding period.

Charterhouse and CVC's Ista receives second round bids

Charterhouse and CVC Capital Partners are receiving second round bids for German energy-metering firm Ista, in an auction that could fetch €3bn, according to reports.

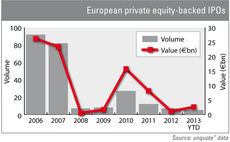

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Steadfast promotes Buschmann and Geiger to partnership

Steadfast Capital has promoted Kay Buschmann and Markus Geiger to partners.

Earlybird joins Auctionata investors in new funding round

Earlybird has joined existing investors Bright Capital and Kite Ventures in a new funding round for German online auction house Auctionata, estimated at around $2.7m.

DACH unquote" April 2013

The German government’s draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class.

Founder of CEE GP Penta steps down

Martin Kúšik, the co-founder of central European investment group Penta Investments Group, will end his operational involvement in the firm he set up in 1994.

HTGF et al. reinvest in Altruja

High-Tech Gründerfonds (HTGF), Bayern Kapital and Extorel have backed German social fundraising software Altruja in a second financing round, alongside new investors Mun-ic and HP Capital.

CGS III closes above target

CGS has closed its third fund on CHF 208m, above its original hard-cap.

WHEB Partners backs Hoffmeister Leuchten

WHEB Partners has invested in German low-energy lighting business Hoffmeister Leuchten GmbH.

HTGF et al. in €2.6m Transcatheter Tech series-B round

High-Tech Gründerfonds (HTGF), Tubaflex Beteiligungs GmbH and others have backed a €2.6m series-B round for German biotech business Transcatheter Technologies, a developer of transcatheter heart valve technology.

Reed Elsevier leads $10m series-B round for Babbel

Reed Elsevier Ventures has led a $10m funding round for German online learning business Babbel, which also attracted investment from IBB Beteiligungsgesellschaft, Nokia Growth Partners and Kizoo.

Gimv sells stake in Halder

Belgian private equity firm Gimv has handed back its stake in fellow German private equity house Halder to the GP.

PE-backed Bauwerk Parkett merges with Boen

Zurmont Madison Private Equity and EGS Beteiligungen's Swiss portfolio company Bauwerk Parkett AG has merged with Norway-based Boen AS to form the Bauwerk Boen Group.

Deutsche Beteiligungs AG acquires Stephan Machinery

Deutsche Beteiligungs AG (DBAG) has acquired German business Stephan Machinery, a manufacturer of food processing machinery, in an MBO valued at €40m.

PVP closes €3m series-A for CryoTherapeutics

Peppermint Venture Partners (PVP) has joined an investor consortium including High-Tech Gründerfonds (HTGF) in a €3m series-A round for German biotech company CryoTherapeutics.

German banking reform threat to private equity

The German government's draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class. Carmen Reichman...

Iris Capital leads reBuy round

French VC Iris Capital has led a funding round for Germany-based used products e-commerce website reBuy.

TA Associates invests in Onlineprinters

TA Associates has backed German printing business Onlineprinters.

ECM acquires Bergmann Automotive

Equity Capital Management (ECM) has acquired a majority stake in German industrial business Bergmann Automotive, alongside management and the company's family owners.

i4g and tecnet back VisoCon

Austrian private equity firm i4g and tecnet equity have invested in a seven-figure financing round for Graz-based technology company VisoCon GmbH.