DACH

DBAG VI hits €700m hard cap

Deutsche Beteiligungs AG (DBAG) has closed its sixth fund at €700m, breaking its target and reaching its hard cap.

Summit Partners raises $520m credit fund

Summit Partners has raised a $520m credit fund for middle-market companies, far surpassing its original $300m target.

Capital Dynamics promotes five

Capital Dynamics has promoted five staff members to managing director since the start of 2012.

AXA PE acquires frostkrone from Argantis

AXA Private Equity has acquired German frozen finger food producer frostkrone and its subsidiary Bornholter in an SBO from Argantis Private Equity.

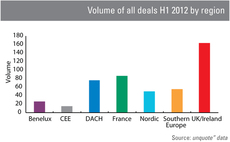

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

HTGF et al in series-B for Customer Alliance

High-Tech Gründerfonds (HTGF), Mountain Super Angel, K5 Ventures and netSTART Venture have invested in a second round for Berlin-based software-as-a-service provider Customer Alliance.

Equistone takes majority stake in Vivonio

Equistone Partners Europe has taken a 67% stake in German furniture maker Vivonio Furniture Group, a newco formed by combining Orlando Management-backed MAJA, Staud and SCIAE.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

Equita CoVest in €115m first close

Equita Management has held a €115m first close for its Equita CoVest fund.

The State at play: Italian government jumpstarts flat market

The State at play

Cross acquires Micromacinazione

Swiss firm Cross Equity Partners has acquired a majority stake in Swiss micronisation technologies and services company Micromacinazione.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

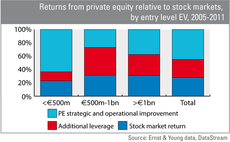

Mid-market leads value creation

Mid-market leads value creation

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.

Moody's cuts German credit outlook

Moody's has indicated it may downgrade Germany's Aaa credit rating, which could make financing operations in Germany more difficult.

AIFMD having little impact on fund marketing

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

AXA PE buys Schustermann & Borenstein

AXA Private Equity has bought German fashion exporter Schustermann & Borenstein in an MBO that reportedly values the company at $370m.

Akina holds first close on €173.5m

Akina Partners has held a first close for its fifth fund-of-funds, Euro Choice V, on тЌ173.5m.

Former Metro boss launches PE house in Germany

Former Riverside partners Kai Köppen and Volker Schmidt have partnered with ex Metro boss Eckhard Cordes and former Apax partner Christian Näther to form a new buyout house in Munich, local reports suggest.

Renewed confidence in alternative energy

Alternative energy

Sun-backed Neckermann files for insolvency

Sun European Partners' German mail-order portfolio company Neckermann has filed for insolvency following unsuccessful talks with the PE firm.

HTGF et al. invest €1m in Data Virtuality

High-Tech Gründerfonds (HTGF) and Technologiegründerfonds Sachsen (TGFS) have invested €1m in German software start-up Data Virtuality.

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.