DACH

Vienna bourse set for IPO comeback

It has been a tough few years for Vienna’s stock exchange but an ambitious new CEO and several planned private equity IPOs over the next two years could see the bourse become attractive again to private equity. Carmen Reichman reports

CVC-backed Evonik announces IPO

CVC Capital Partners-backed German chemicals maker, Evonik Industries, has confirmed plans to float in the Prime Standard segment of the Frankfurt stock exchange.

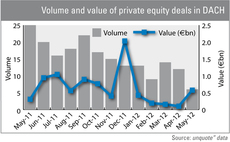

DACH investment leaps forward in May

Investment in the DACH region surged forward in May, with seven deals worth an estimated €580m, compared to 12 deals worth just €100m in April.

Equistone in €1bn Global Blue exit

Equistone Partners Europe (formerly Barclays Private Equity) has sold travel payment service provider Global Blue to Silver Lake Partners and Partners Group in a €1bn deal.

Swiss PE market threatened by regulatory reform

Regulation to hit Swiss PE market

DACH unquote" May 2012

Germany has recently reformed its insolvency law with the introduction of ESUG, the Act for Further Facilitation of the Reorganisation of Enterprises, which promises to make it easier for businesses to get out of administration and back on their feet....

Invest AG set to buy Philips' Speech Processing unit

Invest AG, the private equity arm of Raiffeisen Banking Group Upper Austria, has agreed to buy Philips' Speech Processing unit.

Buyout houses circle €1bn Global Blue

EQT, BC Partners, TH Lee Partners, Silver Lake Partners and Partners Group have reportedly entered a second round of bidding for Equistone's tax-free retail services company Global Blue.

LinkedIn co-founder joins Earlybird

LinkedIn co-founder Konstantin Guericke has joined German technology venture capital firm Earlybird as a partner.

Lawyers: your most valuable asset?

Lawyers: a valuable asset?

HTGF et al. inject €4.3m into Algiax Pharmaceuticals

High-Tech Gründerfonds (HTGF), private investors and promotional bank KfW have provided German biotech company Algiax Pharmaceuticals with a €4.3m seed funding round.

HTGF backs €1.45m t-cell round

High-Tech Gründerfonds (HTGF) has joined a €1.45m round for regenerative therapies developer t-cell Europe GmbH.

Pinova buys Norafin Industries in MBO

Pinova Capital has acquired German speciality textile producer Norafin Industries from MAJ Invest’s holding company Vernal.

DFJ Esprit leads $7m series-B for Moviepilot

DFJ Esprit has led a $7m series-B financing round for movie recommendation and discovery platform Moviepilot.

Fundraising activity up by 80% in 2011

European private equity and venture capital fundraising increased by 80% in 2011, according to recent figures released by EVCA.

eCAPITAL invests in HTGF portfolio firm Smart Hydro Power

eCAPITAL has led a €2.7m capital increase for High-Tech Gründerfonds (HTGF) portfolio company Smart Hydro Power.

Argos Soditic acquires ASC International House

Argos Soditic has completed the MBO of Swiss education provider ASC International House.

HTGF et al. invest in fos4X

High-Tech Gründerfonds (HTGF), Bayern Kapital and UnternehmerTUM's venture capital arm have invested in fibre-optic measurement business fos4X.

Balderton seeds Archify

Balderton Capital has completed a seed investment in Austrian technology company Archify.

High yield to revive Europe's loan market

High hopes for bonds

Lloyds announces six senior promotions

Lloyds's acquisition finance team has promoted six professionals to senior positions across Europe.

TA Associates exits eCircle

TA associates has sold German digital marketing company eCircle to American analytic data solutions company Teradata.

HgCapital acquires Qundis Group for €160m

HgCapital has acquired a majority stake in Qundis Group, a German provider of submetering devices and systems for consumption-dependent billing of heat and water, alongside other institutional clients of HgCapital.

Triton sells Dunkermotoren to Ametek

Triton Partners has sold German electronics company Dunkermotoren to US manufacturer Ametek.