DACH

Mid Europa and France Telecom-Orange sell Orange Austria for €1.3bn

Mid Europa Partners and France Telecom-Orange have agreed to sell their combined 100% share in Orange Austria to Hutchison 3G Austria for €1.3bn.

Afinum's Caseking buys Overclockers

Afinum portfolio company Caseking has acquired UK-based ecommerce business Overclockers UK.

HTGF et al. invest in Conceptboard

High-Tech Gründerfonds and Seedfonds Baden-Württemberg have provided funding for cloud software provider Conceptboard.

Jersey launches private placement scheme

Jersey has introduced a private placement scheme for institutional and professional investors.

BayBG invests in Prevero

BayBG has backed software company Prevero with a mezzanine structure in the form of a silent partnership.

2011 a bumper year for Nordic fundraising

Fundraising activity declined slightly in 2011 compared to the previous year, as the market remains tough and LPs selective. Not all European regions fared equally though, with the Nordic countries and France attracting significant amounts of capital....

BayBG invests in Rosner Fashion

BayBG has taken a 43.5% stake in clothing retailer Rosner Fashion as part of a capital increase.

Deal volumes hit 15-year low

Deal volumes in Q4 2011 hit their lowest levels since 1996, in a difficult final quarter for the private equity industry, according to the unquoteт Private Equity Barometer, in association with Arle Capital Partners.

Debt providers: "One-stop shops" gaining ground

Faced with a tough bank lending environment, PE houses are increasingly turning to тone-stop shopsт to leverage their deals. Indeed, alternative debt providers are looking forward to a busy 2012, as Greg Gille finds out.

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

Dechert opens in Frankfurt; poaches Mayer Brown partner

Private equity specialist Dr. Benedikt Weiser will join Dechert next month from Mayer Brown, where he was head of the firmтs German Private Investment Funds group.

Syntegra returns to fundraising after seven years

Syntegra Capital has confirmed that it is raising a new fund. The firm expects to hold a first closing on тЌ75m in the first quarter of 2012. Amy King reports

DBAG acquires Brötje-Automation

Deutsche Beteiligungs AG (DBAG) has taken over industrial machinery provider Brötje-Automation from CLAAS Group for an undisclosed amount.

Deutsche unquote" January 2012

The EU is proposing changes to the directive on Institutions for Occupational Retirement Provision (IORP) that would impose Solvency II-like capital requirements on funds of occupational retirement schemes.

BPE-backed VTN acquires EFD

BPE Unternehmensbeteiligungen has acquired 100% of the shares of EFD Härterei Fritz Düsseldorf through its portfolio company VTN Beteiligungs.

BayBG invests in BMI

BayBG has invested an undisclosed amount in dairy company BMI Bayerische Milchindustrie in the form of a silent partnership.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

DN highlights venture revival

Six exits in 18 months; two portfolio companies bought by Oracle in 2011 alone. One firm is living the dream. Kimberly Romaine reports.

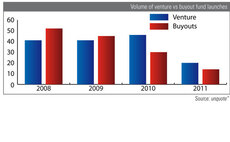

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

Matlin Patterson exits Securlog

Matlin Patterson has sold cash transport provider Securlog to Spain-based security solution provider Prosegur for €22.7m.

Access Capital Partners closes fund on €500m

Access Capital Partners has held a final close of its fifth European small- and mid-market fund-of-funds, Access Capital Fund V Growth Buy-out Europe (ACF V), on тЌ500m т above its initial target of тЌ350m.

IK Investment Partners hit by carried interest row

The Swedish tax authority's battle over carried interest taxation continues as another player is drawn into the feud. Sonnie Ehrendal investigates.

Summit Partners holds final closing of venture fund on $520m

Summit Partners has announced the final closing of the Summit Partners Venture Capital Fund III on $520m.

Summit Partners' eighth fund closes on $2.7bn

Summit Partners has announced the final closing of Summit Partners Growth Equity Fund VIII on $2.7bn.