DACH

Paragon-backed Apontis Pharma sets IPO price range

Shares are priced at €18.5-24.5, with a final pricing expected on 6 May before the 11 May listing

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Capza closes fifth debt fund on €1.6bn, prepares new launch

Fund invests in SMEs with EBITDA of more than €12m, providing unitranche and mezzanine

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

Endeit Capital holds final close for third fund on €250m

Fund II closed on тЌ125m in 2016; Fund III will continue to invest scale-up capital in European startups

Corten buys Emeram's Matrix42

SBO of the digital workspace software is Corten's first investment from its €392m debut fund

Gilde Healthcare buys Acti-Med

Deal is the fourth platform investment from the GP's €200m Gilde Healthcare Services III fund

Capiton, Nord Holding sell Engelmann Sensor to DPE

Smart meter business is the final portfolio company in Capiton's 2010-vintage fourth fund

Telemos Capital acquires Mammut

Conzzeta began to explore sale options for the Swiss outdoor clothing and hardware brand in 2019

Maguar Capital invests in Bregal-backed STP

Maguar partner Gunther Thies founded STP; partner Arno Poschik was on STP's board during his time at Hg

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

KKR sells minority stake in Hensoldt

Leonardo is to buy the 25.1% stake for €606m; KKR will retain an 18% stake in the sensor developer

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

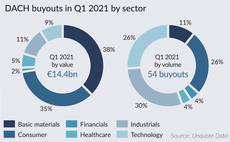

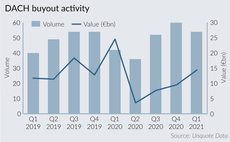

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries

Paragon acquires Bregal's Sovendus

Bregal acquired a minority stake in the e-commerce customer reward platform in 2015

AlpInvest Co-Investment Fund VIII closes on $3.5bn

ACF VIII invests alongside GPs in private equity buyouts and growth capital transactions across a variety of sectors

SHS sells stake in Medigroba to trade

Medical homecare provider Medigroba received significant inbound interest from strategic buyers

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Paragon-backed Apontis Pharma announces IPO intention

Paragon acquired the pharmaceutical business from its parent company UCB in 2018 via Paragon II

Hg's MeinAuto announces intention to float

Hg invested in the new car sales platform in 2018; prior backers included HV Capital and DN Capital