France

Eurazeo gears up for Eurazeo Capital V

GP has registered the fund almost three years after the EUR 2.5bn final close of its predecessor

Astorg adds new partner to Paris office

With addition of Jean Raby, Astorg will establish two new functions

Payot sale interrupted as Weinberg drops out

LBO France-backed French skincare company’s exposure to the Russian market was major issue raise by bidder

Teachers' Venture Growth leads Alan's EUR 183m Series E

Temasek, Index, Coatue, Ribbit Capital, Exor, Dragoneer, and Lakestar also joined the round which values Alan at EUR 2.7bn

Cipio holds EUR 202m final close for Fund VIII

Technology growth capital and primary buyout vehicle plans to make four to six deals per year

Phoenix sells 1000Heads to PE-backed Labelium

Phoenix Equity Partners has sold its stake in UK-based social media data and consultancy firm 1000Heads to France-headquartered Labelium, a portfolio company of Charterhouse Capital Partners.

Squire Patton Boggs makes France and Italy partner hires

Anthony Guillaume and Benjamin Marché join the Paris team, while Sara Belotti joins in Milan

SwanCap closes fifth fund at EUR 420m

New vehicle will make primary, co-investment and secondary deals; close to 50% deployed

Latour sells Atlas For Men to Motion Equity

Vendor owned the French menswear retailer for just three years; buyer participated in 2019 auction

LGT sells Batisanté to IK Partners

New owner investing via Fund IX; looks to grow the company organically

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

IK pre-empts Batisanté sale at the start of second round

LGT-owned building hygiene and safety specialist attracted interest from several other financial sponsors

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Tilt Capital holds first close for debut energy transition fund

Co-founder Nicolas Piau speaks to Unquote about the GP's Siparex partnership. fundraise and strategy

Qualium III expects autumn final close

Vehicle will follow the investment strategy of its predecessor and has a EUR 500m target

IK Partners sells Recocash to Qualium Investissement

Deal marks the third exit from IK Small Cap II, which is at least 93% deployed

LGT's Batisanté draws interest from multiple sponsors in hotly contested sale

GPs including Chequers, Equistone, IK, Latour and Naxicap are circling the LGT-backed firm

Hg bolsters team with promotions and new hires

GP has promoted three to partner and fills newly created role, head of talen

Capital Croissance gears up for Smart AdServer exit

GP bought a majority stake in the France-based digital advertising platform from Cathay in 2021

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

Inovexus gears up for seed investments in AI, blockchain, metaverse startups

Evergreen fund's LPs include Crédit Agricole, according to Inovexus CEO and founder Philippe Roche

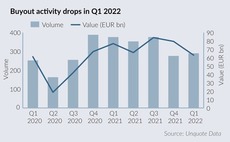

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

Bridgepoint in exclusivity to acquire G Square's Dentego

Mergermarket reported that sponsors including Ardian, BC, Eurazeo and IK showed interest in the asset