France

EdRIP backs Groupe DEFI spin-off

Edmond de Rothschild Investment Partners (EdRIP) has taken a minority stake in the management buyout of French advertisement technology specialist Groupe DEFI.

Idinvest holds first close at €100m

Idinvest Partners has held a first close for Idinvest Secondary Fund at €100m.

Cathay Capital wins €150m Franco-Chinese mandate

French state-backed Caisse des Dépots et Consignations and the China Development Bank have co-funded a €150m investment fund to be managed by Franco-Chinese GP Cathay Capital.

Patron hits €880m for fourth fund

Patron Capital Partners has reached a final close on its fourth fund at тЌ880m.

FSI Régions backs Travel & Co bolt-on

Travel & Co, a French tour operator backed by FSI Régions, has acquired New Zealand travel specialist Nouvelle Zélande Voyages.

OpenGate buys Zodiac Recreational

OpenGate Capital has acquired French inflatable boats manufacturer Zodiac Recreational from its parent Zodiac Marine & Pool, a Carlyle portfolio company.

Pinsent Masons opens Paris office

Law firm Pinsent Masons has opened a new office in Paris, with a team coming over from Mazars' legal arm Marccus Partners.

Initiative & Finance exits Nomadvance in trade sale

Initiative & Finance has sold its stake in French tracking technology specialist Nomadvance in a trade sale to Hub telécom.

Foreign GPs boost Nordic buyout figures

Two months into the second half of 2012 and buyout statistics for the Nordics send out mixed signals.

AXA PE backs Place des Leads

AXA Private Equity has invested €3m in Paris-based data collection company Place des Leads in exchange for a minority stake.

Top 5 exits of 2012 so far

Top 5 exits of 2012

XAnge bolsters team

French growth capital firm XAnge Private Equity has hired Nicolas Debock as a senior chargé d'affaires.

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards

Would the real CEE please stand up?

Confusion over CEE stats

AXA PE kicks it up a gear in 2012

AXA Private Equity (AXA PE) may have mainly attracted attention last year with the start of its spin-off from French insurer AXA, but the firm is letting its deal teams do the talking in 2012. Greg Gille reports

Flood of businesses for sale expected

Sale flood expected

123Venture et al back Global Hygiène MBI

123Venture, A Plus Finance and Calliode have invested in the management buy-in of French paper products manufacturer Global Hygiène.

Olympic legacy to accelerate UK venture

Accelerating European venture

PE-backed Télédiffusion sells Finnish subsidiary

Télédiffusion de France (TDF), a French operator of broadcast towers backed by a private equity consortium, has sold its Finnish operation Digita Oy to First State Investments, the overseas investment unit of the Commonwealth Bank of Australia.

21 Centrale buys Cleor off Azulis

21 Centrale Partners has taken a majority stake in the management buyout of French jewellery retailer Cleor.

Intel Capital leads €6.5m series-C for Movea

Intel Capital has led a €6.5m series-C funding round for French technology firm Movea.

21 Centrale Partners creates outdoor accommodation group

21 Centrale Partners has created an outdoor accommodation group by merging its portfolio company Vacances Directes with newly acquired business Village Center.

Summit Partners raises $520m credit fund

Summit Partners has raised a $520m credit fund for middle-market companies, far surpassing its original $300m target.

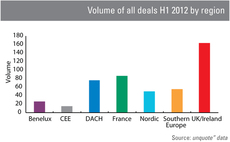

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.