France

Consortium in €20m funding round for Tehtris

Cybersecurity software platform drew investment from sponsors including Ace Management

Aglaé, BPI France lead $30m series-B for Livestorm

Raise Ventures and Idinvest also take part in the round, which brings the total amount raised by Livestorm to $35m

Turenne backs ABL Lyon

GP invests via Turenne Capital Santé 2, a healthcare-dedicated fund with a €165m hard-cap

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

Novalpina buys majority stake in Laboratoire XO

Deal reportedly values the company at more than €300m, and unitranche debt was provided by debt fund manager Ares

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

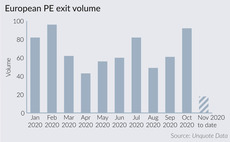

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Crédit Mutuel Equity et al. invest €75m in Chausson Matériaux

Irdi Soridec Gestion, BNP Paribas, Grand Sud-Ouest Capital and Idia Capital also invest

Initiative & Finance appoints Ardian's Pihan as partner

Pihan joins the firm's mid-cap team, which leads the strategy of Tomorrow Private Equity Fund

Andera, Capza reinvest in Octime in minority SBO

Andera (then EdRip) acquired a majority stake in the business along with management in 2016

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Mutares carves out two units from Gea Group

Deal includes the companies' sites located in France and the Netherlands, with a total of 230 employees

360 Capital to launch €50m Square II fund

360 Square II will deploy equity tickets of €500,000-3m, primarily across France and Italy

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Motion Equity to take Olmix private

GP intends to launch a voluntary offer with the aim of de-listing the company by the end of 2020

LBO France completes FH Ortho trade sale

LBO France acquired the company via its €154m Hexagone III fund in 2014

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

Eurazeo, IK invest €400m in Questel

Eurazeo, IK and Raise intend to further boost Questel's growth and international expansion in Europe, Asia and the US

LBO France buys majority stake in Prenax

Andera has reinvested and Prenax has acquired LM Information's subscription management business

AnaCap carves out Market Pay from Carrefour in €300m deal

Deal sees Carrefour retain a minority stake, alongside the company's founders, Frédéric Mazurier and Isabelle Clairac

Secondaries update: Unigestion's David Swanson

Secondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals

Naxicap acquires Eureka Education from Abénex, Finoli

Professional and higher education provider pursued a buy-and-build strategy under Abénex's ownership

Ardian bolsters buyout team with five new MDs

Scarlett Omar Broca and Heiko Geissler join in Paris and Frankfurt, respectively

Blackstone Core Equity Partners II closes on $8bn

BCEP II follows a long-hold private equity strategy, with an investment period of 15 years