France

StepStone closes fourth secondaries fund on $2.1bn

SSOF IV's investment strategy focuses on the inefficient segments of the secondaries market

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

How private equity is helping fight the Covid-19 outbreak

A round-up of initiatives by GPs across Europe т and their portfolio companies т to help their communities

Eurazeo to set up €10m Covid-19 solidarity fund

GP wants to suspend its 2019 dividend, and senior execs will contribute 10% of their bonuses to the fund

Insight Partners XI closes on $9.5bn

Fund deploys equity tickets in the $10-350m range in startups operating across the software industry

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

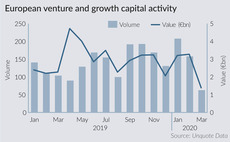

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Bridgepoint buys 28% stake in French asset manager Cyrus

GP invests via its lower-mid-cap fund Bridgepoint Development Capital III, which raised around £600m

A/O Proptech leads series-B round for Qarnot Computing

Caisse des Dépôts, Engie and Groupe Casino also participate in the round

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Essling-backed SPVIE bolts on Assurances de l'Adour

GP is investing from Essling Expansion Fund, a vehicle dedicated to the French lower-mid-market

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

French PE steps up gender diversity goals and monitoring

French private equity association France Invest launched its gender-parity charter at IPEM

Argos-backed Factum buys AGL Services

Deal is part of Factum's aggregation strategy and follows two bolt-ons inked in January 2019

Siparex et al. exit Kiwatch to trade

Management team led by co-founders Williamson and Blanchard will stay on with the business

Milestone's Dehaen bolts on Max Plus; Sodero exits

Senior debt to finance the deal is provided by CIC Ouest, Banque Populaire Grand Ouest and Caisse d'Epargne

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019