France

Nystrs considering further European fund commitments

US pension fund has increased the number of active partnerships in its private equity portfolio

Strong exit environment helps drive Pantheon's returns

Sales to corporate buyers were the most significant source of exits, PIP says in its results

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

Hamilton Lane asset footprint hits record high

Firm plans to keep growing its existing funds across primary, co-investment and secondary strategies

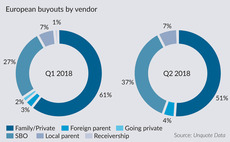

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

LBO France et al. back Deezer

Consortium of investors injects €160m in France-based music streaming service Deezer

Charterhouse acquires Funecap

Management equally reinvests in funeral service Funecap, which posts an EBITDA of around €40m

HIG's Valtris bolts-on Ineos divisions

Valtris buys France-based Ineos Baleycourt and Benelux-based Ineos ChloroToluenes

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Ardian's Trigo bolts-on SCSI

SCSI represents the sixth acquisition since Ardian bought France-based Trigo in 2016

Unigrains acquires Mecatherm in €120m deal

With acquisition of Mecatherm, Unigrains plans to strengthen is agricultural network

3i-backed Ponroy buys Densmore

Second bolt-on the group has made since 3i's initial buyout of the business in 2016

Pemberton targets €2.5bn for second European debt fund

Vehicle's 2016-vintage тЌ1.2bn predecessor is now understood to be fully deployed

Tikehau holds first close, launches fund

French GP's TGE II backs SMEs across western Europe with EBITDA in the €5-50m range

BDC to exit dental imaging company Acteon

Acteon was the second investment in France made by Bridgepoint Development Capital II

CapDecisif holds first close for CapDecisif 4

VC is aiming to exceed its €50m target but will not surpass the €70m assigned hard-cap

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape

BPI France sells CPI to trade

French book printing group CPI is bought by Netherlands-based Circle Media Group

Argos Wityu buys Juratoys in MBO

Juratoys was previously owned by US-headquartered Alex Brands, backed by Propel Equity

CVC sells Linxens to trade in $2.6bn deal

France-based smartcard parts maker Linxens is sold to Chinese conglomerate Unisplendour

BPI France, Latour buy Plastic Omnium Environment

Latour Capital is currently investing via its Latour Capital II vehicle that closed on €306m

Naxicap's SushiShop sold to trade for €240m

Poland-based restaurant group AmRest acquires the France-based Japanese restaurant in a €240m deal

Initiative & Finance invests in Proferm

GP buys a minority stake in French carpentry specialist Proferm, CEO Dejonghe retains majority

Rocket Internet launches second fund

Rocket Internet Capital Partners I held a final close on its $1bn hard-cap in January 2017