Nordics

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

CVC exits Etraveli in EUR 1.63bn trade sale

CVC acquired the online flight booking platform from ProSiebenSat.1 in 2017 in a EUR 508m deal

Valedo's Norva24 to list in Stockholm

Since inception in 2015, Norva24 has grown from NOK 150m in revenues to NOK 2.1bn

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn

Altor, Equistone, Polaris among bidders for Troldtekt

Danish manufacturer of acoustic panels is in an advanced process led by Clearwater

Balderton raises USD 600m for eighth flagship fund

Fund will continue the VC's Series A-focused strategy, targeting European startups

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan У kesson and head of IR AdalbjУЖrn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans

Adelis III holds EUR 932m final close

Stockholm-headquartered GP's predecessor fund held a final close in 2017 on EUR 600m

Monterro 4 holds EUR 700m final close

GP will now be making new platform deals from the fund, continuing to focus on Nordic B2B software

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

DWS holds USD 550m final close for first PES fund

GP's first institutional fund will partner with lower- and mid-market GPs for mid-life secondaries

General Atlantic flagship fund GA 2021 closes on USD 7.8bn

Sixth flagship growth equity fund is more than twice the size of its USD 3.3bn predecessor

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

EQT acquires LSP, forming EQT Life Sciences

Announcement follows Life Sciences Partners' seven-month, EUR 850m fundraise for LSP VII

IK buys Truesec from Sobro

Cybersecurity firm is IK's seventh platform investment of H2 2021 and its fourth deal since October

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

PAI exits Atos Medical in EUR 2.2bn trade sale

PAI acquired the laryngotomy and tracheostomy care products company in an SBO from EQT in 2017

eEquity reaps 15x on sale of PriceRunner to Klarna

Deal values PriceRunner at more than SEK 9bn, allowing eEquity to exit in less than two years

Kempen holds EUR 173m first close for European Private Equity Fund II

New fund is focused on small and lower-mid-market private equity buyouts in Europe

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

Procuritas backs Strandberg Guitars

GP is backing the headless guitars producer via its EUR 318m Capital Investors VI fund

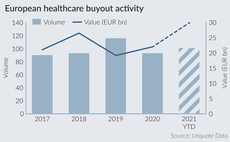

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

Tenzing sets sights on Nordic countries

Unquote catches up with managing partner Guy Gillon following the appointment of Magnus GottУЅs to lead Tenzing's Nordic expansion