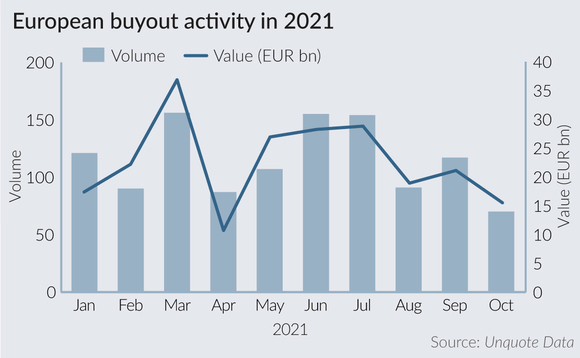

Announced PE deals fall sharply in October

The volume of private equity buyouts in Europe was down sharply in October compared with the previous month, according to Unquote Data.

Sponsors announced 70 buyouts in October, worth a combined estimated enterprise value of EUR 15.5bn, the data shows. This is down significantly on the 117 deals worth EUR 21.1bn recorded in September, and would make October the least busy month of the year in terms of deal volume so far: August saw 91 buyout transactions announced, while 87 were recorded in April.

By comparison, June and July saw more than 150 deals each, with total EV in the region of EUR 28bn per month.

Although Unquote researchers will inevitably unearth more (usually smaller) deals inked in October through secondary research down the line, that is unlikely to drastically alter the unfavourable comparison with previous months.

While the environment remains highly conducive to deal-doing, with record-high valuations and a significant amount of PE dry powder ready to be deployed, recent conversations with deal-doers and advisers highlight that the market could be a victim of its own earlier success.

The lack of availability of over-booked due diligence advisers is one anecdotal factor mentioned in relation with the difficulty in progressing some processes. A more selective and pricier M&A insurance market is another, as reported, with some companies turning to insurance as a way to alleviate diligence pressures caused by the pace of M&A. While still acting quickly, insurers are now taking longer to write business and becoming more selective, adding to the current slowdown in M&A activity, according to one private equity investor.

It remains to be seen whether this October dip is a mere blip (as was seen in February and April earlier this year) or indicative of a more generalised slowdown in M&A following a record-breaking first half of 2021.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds