Nordics

Level 20 names Pam Jackson as new chief exec

Jackson succedes Jeryl Andrew, who will retire from the role at the end of the year

Northzone closes ninth fund on $500m

NZ IX invests primarily in series-A and series-B rounds, financing companies based in Europe and the US

Cardlay secures €9m funding round

Company also agreed to partner up with Eurocard, the largest card issuer in Scandinavia

EQT closes Ventures II on €660m

EQT Ventures II will back European startups and US companies looking to expand in Europe

CVC closes second growth fund on $1.6bn

Fund targets high-growth, mid-market technology companies based in North America and Europe

DevCo Partners raises €180m for next platform deal

Firm launched its latest vehicle before the summer and sought to attract a broader base of investors

Vostok leads $85m series-B for VOI Technology

Consortium of investors supporting the funding round includes existing and new backers

Team spirit: the enduring appeal of co-investment

This year, тЌ7.87bn was collected across seven co-investments funds, breaking Unquote Data records

Q3 Barometer: deal volume hits new record with mid-market push

Buyout market has been strengthening consistently and was only four deals away from hitting 300 in the third quarter

Omers Ventures leads €18.5m series-B for FirstVet

Fresh capital will enable FirstVet to expand its service globally and launch in other markets

EQT sells minority stake in Anticimex to GIC

Singaporean sovereign wealth fund invests in a deal that values the company at around тЌ3.6bn

Nordic Capital aiming for further Munters sell-down

Nordic Capital already made a partial sell-down earlier in the year, selling 25 million shares at SEK 44 apiece

Denso et al. in €15m round for Canatu

New investor 3M Ventures and existing investor Faurecia also participate in the round

FSN acquires majority stakes in Fellowmind, eCraft, Orango

Transaction aims to drive consolidation in the business software provider market

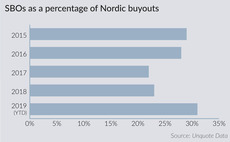

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

Crane leads $5m round for Forecast

Existing Danish investors Seed Capital and Heartcore also participate in the round

Altor, TDR secure stakes in Thomas Cook Northern Europe

Acquisition will safeguard the jobs of 2,300 people working for the profitable division

Nordic Capital-backed Conscia buys XevIT

Conscia intends to boost its expansion across the DACH region and further consolidate its market position

Blue Water Energy, Nixon Energy acquire Varel

Sandvik will retain the company's mining supply operations, a 30% stake and a board seat

Adelis backs insurance broker Säkra

With the GP's support, SУЄkra plans to further strengthen its market position and expand its offering

HIG to acquire Meyra and Alu Rehab

HIG has acquired the two mobility products manufacturers, with the intention of merging them

Danish pension fund ATP nets record returns

Private equity portfolio returned DKK 2.6bn over the first three quarters of 2019

Polaris acquires SSG Group from BWB Partners

Polaris secures a majority stake in Denmark-based SSG Group alongside the management team

Verdane buys CAP-Group

All the entrepreneur shareholders will stay on as minority owners in the business