Nordics

Triton acquires Dantaxi 4x48

Company plans to build its position as market leader in the professionalisation of the taxi industry

LP Profile: Skandia Insurance Company

Head of private equity and infrastructure Jonas Nyquist talks to Unquote about the LP's investment programme

Skandia raises SEK 180m for fund-of-funds

Vehicle was launched in January 2018, with approximately the same target as Thule Buyout Fund II

Litorina-backed Fresks acquires XL-Bygg Mellerud

Founder of the company will reinvest a significant part of the proceeds from the transaction

Atomico leads $31m series-B for Varjo

Funding will be used to scale Varjo's teams from 80 to 200 over the next 12 months

Introducing the new Unquote weekly updates

Get our latest content based on your favourite topics, regions and sectors straight to your inbox every week

Terra Firma et al. acquire Parmaco from MB

Transaction reportedly gives the Finnish real estate business an enterprise value of €400m

VER seeks portfolio administrator for illiquid investments

Interested candidates can apply by submitting an application in Finnish or English

Herkules spinout Equip prepares fund launch

Former managing partner Sverre FlУЅskjer is leading the spinout under the name Equip Capital

Verdane exits JSB Group

Deal supports JSBтs corporate strategy by combining business activities to grow scale and resources

Segulah snaps up Conapto

Deal is the seventh investment for Segulah V, which held a final close on SEK 2.4bn in 2016

European buyout value reaches post-crisis high

Deal value has been boosted by a spike in тЌ1bn+ deals and strong activity in Southern Europe

Landmark backs single-asset secondaries for PAI's Perstorp

PAI has been invested in the speciality chemicals business, the last asset in PAI IV, since 2005

Verdane exits Scanacon to Alder

Deal marks the end of a six-year holding period for Verdane, which acquired Scanacon in 2012

Private equity tops Nordic LP returns charts

PE outperforms other asset classes in the region, as local LPs continue to increase their allocations to the space

Cherry Ventures backs Hedvig in SEK 30m round

Latest capital investment is intended to help promote the startup's growth as it develops its software

CapMan promotes three

GP promotes Antti Karppinen and Tobias Karte to partners and Tomi AlУЉn to investment director

Northleaf nets $2.2bn for global PE programme

Canadian private markets investor closes its latest secondaries vehicle on $800m

Novo takes 24.9% of Cinven's Envirotainer

Co-investment is announced in partnership with Cinven, two months after the initial buyout

CapMan-backed Digital Workforce raises €3m

Investors in the round include CapMan Growth Equity Fund and earlier seed investors

Folmer acquires Europlan Engineering

GP intends to expand the businesses into new market segments as it pursues a growth strategy

Tesi invests in €6.3m round for Nosto

Fellow Helsinki-based VC firm (and existing investor) OpenOcean also takes part in the financing

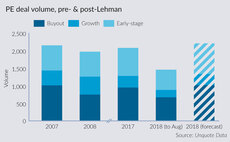

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

Dawn, DN Capital leads $15m series-A for Divido

Deal marks the first investment for Dawn Capital since closing its $235m fund Dawn III