Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Inflexion launches €143m take-private bid for Infront

GP said its experience developing data and technology companies, along with an ability to provide access to additional capital, will contribute to the company's future development

Tenzing invests in MetaCompliance

MetaCompliance generated ТЃ6m in revenues in the year ending on 31 March 2020

Levine Leichtman sells stake in ZorgDomein

Rabobank is to acquire a 34% stake in the healthcare platform via its Corporate Investments arm

Sagard buys Nutrisens from Evolem, Unigrains

Nutrisens management team, led by CEO Georges Devesa, retains a significant stake in the company

Litorina-backed Fractal Gaming Group to list

Intention to list comes four years after the GP acquired the company via its fourth fund

VC-backed Mister Spex buys Tribe

Online optician has previously received VC funding from investors including Grazia Equity and Goldman Sachs

IBB, Picus-backed Getsurance sold to trade

Insurtech company raised €2m in 2017 from Picus Capital and IBB but filed for insolvency in 2020

Lonsdale sells GYG for a 3x return

GYG had a market capitalisation of £35.7m at the time of publication

Iconiq Growth leads $530m round for Wolt

New round takes the total amount Wolt has raised to $856m

Limerston-backed Prism acquires Repose

GP bought Prism via its debut fund, Limerston Capital Partners I, which closed in 2017 on ТЃ220m

Oakley Capital invests €175m in EQT's Idealista

GP backs the company via Oakley Capital IV, which held a final close on €1.46bn in July 2019

VC-backed Ubitricity sold to Shell

Investors including Earlybird and IBB previously backed the electric vehicle charging startup

LDC appoints Scales as investment director

Prior to joining LDC, he spent eight years at Rothschild & Co, as a member of its corporate finance team

GP Profile: Clessidra

CEO Andrea Ottaviano discusses the launch of the firm's last buyout fund, as well as dealflow and market perspectives in the wake of Covid-19

Sponsor Capital acquires and merges Likeit, Nepton

Merged company will have combined revenues of around тЌ8m in 2020, and employ over 50 staff.

Holland Capital invests in Cards PLM Solutions

Digitalisation and project life cycle management business intends to expand in DACH and Benelux

Sinergia Venture Fund holds €30m first close

Fund invests in pre-series-A and series-A rounds to support the growth of startups operating across a large variety of sectors

Octopus to launch £100m healthcare-focused fund

In conjunction with the announcement, the firm has hired an investment team from TenX Health

Ufenau buys refrigeration specialist R&M

GP intends to boost the company's growth both organically and via new acquisitions across the refrigeration industry

Carlyle acquires Jagex

Carlyle is expected to pay more than $530m, the purchase price of the business in 2020

Nordic Capital-backed Trustly to list before summer – report

According to a press report, Swedish institutions would like the company to remain in Stockholm

Providence-backed Imaweb bolts on Procar

With this add-on, Imaweb plans to consolidate its presence in the DACH region and broaden its customer base

Permira-backed Dr Martens to publish IPO prospectus

Morgan Stanley and Goldman Sachs are the joint global co-ordinators on the listing

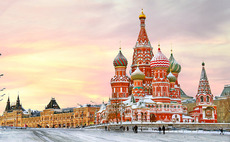

Elbrus holds first close on $260m for third fund – report

Fund has a target of $600m, which it plans to reach by next year, according to Kommersant