Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

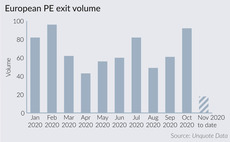

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

LDC sells Babble to Graphite for £90m

LDC retains a minority stake in Babble, while the management team is reinvesting some of its proceeds

PAI acquires Angulas Aguinaga from Portobello

PAI invests in the company via its PAI Mid-Market Fund, which recently held a €500m first close

Eurazeo Brands buys majority stake in Axel Arigato

GP will own the company alongside its founders, Max SvУЄrdh and Albin Johansson

German banks and debt funds split LBO market share in Q3 – survey

GCA's Q3 2020 Mid-Cap Monitor also shows that new financing deals increased in the German market

Agilitas sells Exemplar to Ares Management

Sale ends a four-year holding period for Agilitas, which backed the company via its Agilitas 2015 Private Equity Fund

Bertel O Steen Kapital buys partial stake in ITVerket

Computer services company expects to generate a turnover of NOK 170m (тЌ15.6m) in 2020

Quadriga-backed Scio buys Bilfinger GreyLogix Aqua

Industrial automation company has made three add-ons in 2020 as part of its buy-and-build strategy

Apiary invests in Radiant

Radiant's management team will be led by Peter Mann as chairman and CEO Simon Cogman-Hellier

All Iron Ventures I closes on €66.5m

Fund invests in innovative B2C companies, primarily marketplaces, e-commerce specialists and SaaS startups

Crédit Mutuel Equity et al. invest €75m in Chausson Matériaux

Irdi Soridec Gestion, BNP Paribas, Grand Sud-Ouest Capital and Idia Capital also invest

ECI sells MPM to 3i for £170m

Other sponsors involved in the process included Livingbridge and Graphite Capital

Initiative & Finance appoints Ardian's Pihan as partner

Pihan joins the firm's mid-cap team, which leads the strategy of Tomorrow Private Equity Fund

Riverside sells Swedish Education Group for €18m

GP exits the business nine years after acquiring it via its 2008 fund Riverside Europe Fund IV

Apse buys TerraQuest for £72m

Apse Capital typically backs European tech-enabled SMEs with an enterprise value of тЌ50-200m

Graphite promotes new investment director, hires two

UK mid-cap GP Graphite Capital makes one promotion and two new appointments in its investment team

Finatal launches dedicated PE recruitment practice

New practice complements Finatal Portfolio, which focuses on sourcing talent for PE-backed businesses

Aleph, Crestview back Framestore's acquisition of C3M

The two GPs in 2014 formed a тЌ1.2bn strategic alliance to invest in companies based in the UK and Europe

Endless buys Hovis from Gores, Premier Foods

Endless invests in the business via its Endless Fund IV, which closed on ТЃ525m in December 2014

Hg exits Eucon to trade

Sale ends a four-year holding period for Hg, which backed the company via its Mercury Fund

Andera, Capza reinvest in Octime in minority SBO

Andera (then EdRip) acquired a majority stake in the business along with management in 2016

IK Investment carves out Alba from Alba Baving Group

GP is deploying equity from the IK Small Cap II fund, which closed on its hard-cap of €550m in February 2018

Taste of Italy 2 closes on €330m

Taste of Italy 2 will invest in companies specialised in the food and beverage sector, across its entire value chain

Chiltern backs Inciner8 buyout

Chiltern is an evergreen investor that provides equity cheques of ТЃ3-15m