Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

PAI buys stake in Amplitude from Apax

Sale ends a nine-year holding period for Apax, which bought the business from Weinberg and Initiative & Finance

Notion IV to close in 2020 above £125m target

LPs in the fund include Nuclear Liabilities Fund, Pentland Group, Pool Reinsurance Company and Pruger

LBO France's RG Safety buys Waterfire

Deal is the protective equipment producer's second add-on in Spain since the GP invested in 2017

Kindred's second fund closes on £81m

Kindred is currently projecting that around тЌ5.4m will be returned to founders from Kindred I

VC Profile: VNV Global

Managing director Per Brilioth discusses portfolio company Voi, seeking network effects and investing in companies at the idea stage

Bid Equity's Myneva Group buys Swing

Bid Equity began its social care and healthcare software buy-and-build strategy in 2017

CVC to buy Greek food company Vivartia from Marfin

Marfin has received a binding offer from CVC and granted the GP an exclusivity period until 6 November

Siparex, BPI France sell Duralex to trade

Firms invested in the business in 2015 alongside management, acquiring it from Initiative & Finance

Kinnevik leads $23m series-A round for Joint Academy

Healthtech company has raised $34.2m since being founded six years ago

Afinum buys majority stake in Listan

Computer cooling and energy efficiency hardware company is Afinum's fourth buyout of 2020

Peak Rock acquires Halo Foods

Founded in 1980, Halo generated revenues of ТЃ35.2m in the year to 28 December 2019

French deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in France, courtesy of Unquote sister publication Mergermarket

Stirling Square reinvests in Docu Nordic with TA Associates

Stirling Square is deploying equity from its fourth fund, having previously owned the company via its third fund

Ibla Capital carves out oil & marine business unit of Manuli

GP intends to support the business by consolidating its market position and boosting its expansion

MML hires Bond and Birkin

MML is currently raising for MML Partnership Capital VII, which held a first close in October 2019

Evolution Equity on the road for second fund – report

New York-headquartered venture capital firm held a final close for its debut fund in 2017 on $125m

LGT Lightstone leads €144m round for Infarm

Round for the urban farming startup is the fourth-largest of 2020 in the DACH region

Kahoot! acquires VC-backed Actimo

Listed e-learning company is paying up to $33m for the target company

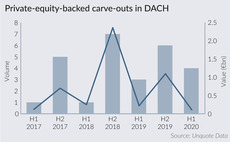

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs

LT Capital acquires Global Partner

IT consultancy plans to open further offices across France and to expand its product portfolio

Quadrivio's 120% Lino buys Rosantica

GP invests via Made in Italy Fund, which targets Italian SMEs across the fashion, design and food industries

Novo, Sanofi lead $83m round for Lava Therapeutics

Corporate venture firms were joined by new and existing investors, including Gilde Healthcare

Nauta Capital leads €4.7m series-A round for HappySignals

New round brings company's total funding so far to тЌ6.2m

EQT buys Casa.it from Oakley Capital

GP invests in the company via EQT IX, which was launched in January 2020 with a €15bn hard-cap