Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Aduram's Poggenpohl sold to trade

Deal has been approved by the company's creditors committee and is expected to close by the end of June

Providence in single-asset restructuring for HSE24

GP bought a majority stake in the shopping channel operator from Ardian in 2012 via its sixth fund

EQT sells credit business to Bridgepoint

There were five or six bidders in the early stages of the sale auction, including Schroders

Hoxton closes second fund on almost $100m

Hoxton Ventures II has a 30% carry rate with a 2.5% management fee and no hurdle

Adara Ventures leads $5m round for CounterCraft

Round also sees participation from existing backers Evolution Equity Partners, Orza and Wayra

Tikehau to buy stake in Euro Group

Tikehau is investing in the energy transformation sector via its T2 Energy Transition Fund

Mobeus leads £4m round for MyTutor

Fresh capital will be used to increase the availability of MyTutor's platform

Schroder Adveq hires Unigestion's van der Kam to head secondaries

Van der Kam was co-head of secondaries at Unigestion and helped build the firm's secondaries platform

KKR to acquire Roompot from PAI

At the beginning of 2020, PAI hired Rothschild to sell the company for an expected valuation of €1bn

Idinvest completes secondaries deal for growth portfolio

Manager has transferred 12 companies into a new fund backed by secondary capital

Fortino acquires majority stake in Sigma Conso

Fortino has acquired Sigma Conso alongside management to expand the company internationally

Atomico leads $27m series-B for Onna

Glynn Capital takes part in the investment, alongside previous backers Dawn, Nauta and Slack Fund

HLD in exclusive negotiations to acquire TSG

Petrol station and fueling equipment provider was formerly owned by its management

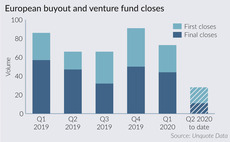

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Seventure, Vostok lead $10m round for TransferGo

Venture capital firms Hard Yaka, Revo Capital and Bootstrap Europe also participate

Go Capital taken over by management

As part of this deal, Jerome Guéret is appointed as CEO and Bertrand Distinguin takes on the role of president

Fly Ventures holds final close for second fund on €53m

Berlin-based VC will continue its focus on seed investments in enterprise software and "deeptech"

KKR's Heidelpay invests in Tillhub

Investment is the contactless payment company's first since it was acquired by KKR in 2019

Lifeline in €6.2m round for Tilt Biotherapeutics

Healthcare startup has raised тЌ18m in funding since its foundation in 2013

Corten closes debut fund on €392m

Corten began raising in January 2019, thus avoiding potential delays in the current market

VCs exit Caroobi to Deutsches Werkstattnetz

Online car repair platform's previous investors included Cherry Ventures, DN Capital and Target Global

Meta Change Capital launches €100m fund

Fund is dedicated to investments in blockchain companies across Europe, Asia, the Middle East and Africa

CapMan to launch first Special Situations fund after summer

Nordic private equity firm CapMan has launched CapMan Special Situations to focus on turnarounds.Т

Vista-backed Accelya bolts on Farelogix

With this add-on, Accelya expects to further expand its end-to-end platform for the airline industry