Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

3i nets £102m from Audley Travel, Hans Anders dividends

3i receives proceeds of ТЃ67m from Audley Travel, while Hans Anders generates a тЌ42m windfall

Aurelius buys ZIM Flugsitz

Founders of the family-owned aircraft seat manufacturer will retain a minority stake in the business

ICG appoints new head of European secondaries

Blossier will work with head of PE funds Oliver Gardey to build out the platform in Europe

Kempen European PE fund closes on €192.5m

Fund was exclusively available to clients of private bank Van Lanschot and asset manager Kempen

Riverside carves out HealthTech BioActives from Ferrer

Deal includes three manufacturing facilities located in Spain, which employ around 140 staff

Capvis buys Tertianum Group

GP acquired the care home group from Swiss Prime Site and will be the company's sole shareholder

Iris Capital, Idinvest et al. inject $12.3m into Yubo

Iris, Idinvest and historical backers invest in the manager of the eponymous social media app

Mérieux Equity Partners backs Addmedica

GP uses its Mérieux Participations 3 fund, which held a first close on €200m in 2018

Ergon Capital buys Palex Medical from Corpfin

GP deploys capital from Ergon Capital Partners IV fund, which closed on €580m in March 2019

Crédit Mutuel Equity buys stake in CF Group

Minority investment aims to boost growth of the swimming pool equipment and materials supplier

Bridgepoint-backed Qualitest acquires AlgoTrace

Founded in 2015, AlgoTrace is based in Petach Tikva, Israel, and employs eight people

Prudentia buys George Mathai

The French GP, founded last year, typically provides tickets in the €2-30m range

One Equity Partners backs Nexion

GP intends to accelerate the company's organic growth and further boost its international expansion

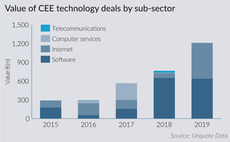

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

BNP Paribas Fortis PE backs JAC

GP buys substantial minority in Belgium-based industrial bread-making machinery specialist

Xenon acquires Koverlux from B4 Investimenti

GP buys the company from private equity house B4 Investimenti and founders Giuseppe and Luca Cerea

PAI-backed Froneri buys Nestlé US ice cream business for $4bn

NestlУЉ will continue to manage its remaining ice cream operations in Canada, Latin America and Asia

Oakley exits WebPros to CVC and re-invests

Exit sees Oakley re-invest for a minority stake and returns of 6.7x and 140% IRR in total

Lindsay Goldberg in talks to sell Schur Flexibles

GP bought the plastic packaging company in 2016 and the exit is expected to complete in Q1 2020

Ada holds first close on £27m

Ada Ventures' founding partners, Francesca Warner and Matt Penneycard, met at Downing Ventures

Made in Italy Fund holds €150m interim close

Fund is managed by Italian GP Quadrivio in partnership with Pambianco Strategie d'Impresa

Quadrivio buys natural cosmetics producer Rougj

GP intends to boost the company's international expansion, especially in the UK, Germany and Asia

MJ Hudson lists in £97m London IPO

Multi-service advisory firm raises ТЃ31.4m from new and existing investors

Main Capital collects €535m for sixth software buyout fund

Buyout fund should hit its €564m hard-cap in January 2020, Unquote understands