Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Ardian invests in TA Associates-backed Odealim

Sponsors will have co-control of the France-based insurance broker, with TA reinvesting

Advent and Lanxess form EUR 3.7bn polymers JV with Royal DSM carve-out

Buyers pay EUR 3.7bn for DEM; the new unit has sales of over EUR 3bn and EBITDA of EUR 500m

Revaia aims for EUR 400m - EUR 500m final close for Fund II by year-end

VC firmтs second fund is expected to be up to double the size of its EUR 250m debut vehicle

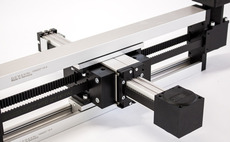

IK exits Bahr Modultechnik in EUR 98m trade sale

IK acquired the modular electric linear motion systems producer in 2018 via its Small Cap strategy

Pemberton assesses European market for NAV strategy

Having hired Tom Doyle from 17Capital, the firm is looking at trends including generational change and market consolidation that will drive demand for strategy

Astorg buys Open Health in SBO from Amulet

The medical communications company was Amulet's only asset outside of North America

Cipio promotes Kirchheim to partner

Ansgar Kirchheim joined the growth capital investor around 18 months ago from High-Tech Gründerfonds

Sun European acquires Tenax

The sponsor invested through its latest fund, Sun Capital Partners VIII, acquiring an 80% stake.

Aurica raises EUR 170m for fourth growth fund

Aurica Growth Fund IV will take minority stakes in companies with an EBITDA of around EUR 4m

GP Profile: Jet Investment doubles down on industrial impact ahead of next fundraise

Central European industrials-focused GP is in the planning phase for Jet 3 Fund and is eyeing further deals and exits

Bridgepoint acquisition of Dentego collapses

GP had entered into exclusive negotiations with vendor G Square following a Lazard-led process

Squire Patton Boggs hires senior partner to Paris office

Maxime Dequesne’s appointment will enhance the law firm’s private equity practice in France

Bain acquires majority stake in Naxicap-backed House of HR

Naxicap will continue its 10-year ownership period, retaining a minority stake in the HR services group

Alcedo could launch Agrimaster sale in late 2022

Italian GP bought the agricultural machinery producer in 2017 via a EUR 30m SBO from B4 Investimenti

Livingbridge taps PwC to explore Helping Hands exit

GP acquired the UK-based home care provider from its founders in 2018 in a Deloitte-led auction

FSN Capital acquires Epista Life Sciences

The GP said it will pursue a buy-and-build strategy in the life science IT services sector

Advent Life Sciences hires three partners

Dominic Schmidt is based in the UK, while Satish Jindal and Katrine Bosley join in the US

Five Arrows kicks off Laf Santé sale

Five Arrows has owned a majority stake in the France-based low-cost pharmacy chain since 2016

Hg's MEDIFOX sale launch draws large-cap sponsor interest

Hg acquired the software platform for care providers in 2018 from ECM Equity Capital Management

Gemba Private Equity heads for EUR 25m close for debut fund

Spanish GP is looking to attract further LPs interested in the local mid-cap space

Inflexion reinvests in Apax-backed Alcumus

Inflexion originally sold the risk management business in February via a GBP 600m SBO to Apax

Silver Investment forms continuation vehicle for PTF

Selling investors have made returns of 6x their original investment in the precision parts producer

Synthesis Capital holds USD 300m final close for debut fund

Costa Yiannoulis and David Welch spoke to Unquote about the food technology and alternative protein VC's strategy

Goldman Sachs AM beats sponsors to buy Norgine

Buyer's PE arm competed with Bain and Cinven in the auction second round