Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

How many more generalists can the Nordic PE market bear?

Competition for capital and assets in the Nordic region has skyrocketed to the point of possible oversaturation

RedSeed leads €4.5m round for Fazland

Backers include Ad4Ventures, the venture capital arm of Italian telecommunications group Mediaset

Vesalius leads €8.3m series-B for Omeicos

Backers in the investment round include KfW Bank, IBB Beteiligungsgesellschaft and Hich-Tech Gründerfonds

Holtzbrinck leads £10m round for Dealflo

Digital documentation business will look to expand into new segments and international markets

Siparex et al. back Viasphère MBO

Capital restructuring enables ICG to exit the French home help services provider

Freshfields poaches five Paris-based partners from Ashurst

Guy Benda, Nicolas Barberis, Yann Gozal, Laurent Mabilat and Stéphanie Corbière leave Ashurst

Thrive and Passion in £19.5m round for Monzo

Online bank and commission-free foreign exchange platform will launch its current accounts service in summer 2017

Maven backs £6.5m buyout of Healthpoint

Deal was funded through Maven's co-investment network and will support the company's product development efforts

Aliter Capital closes maiden fund on £92m

Newcomer will focus on the UK support services sector and has already struck a deal

HIG acquires Swiss IT consulting business Infinigate

Rotkreuz-headquartered company intends to use the fresh capital to expand internationally through add-ons

Capzanine returns to Pierre Guerin with minority investment

Capzanine previously backed an MBO for the stainless steel equipment business in 2006

UK consumer deals slump as GPs heed Brexit warnings

Strong consumer spending figures in the months following the EU referendum have not translated to increased PE investment in the sector

BGF appoints EY's Skade

BGF expands its team in the south-west England region

Draper Esprit leads £9m round for POD Point

VC has invested ТЃ5m in the electric vehicle charge point company as part of the deal

Procuritas-backed Dantherm buys MCS from Alcedo

Transaction sees the Italian GP exit its asset after a five-year holding period

Ventech joins DN Capital in Hostmaker round

UK-based Airbnb management company has raised ТЃ7.5m to date across two rounds of funding

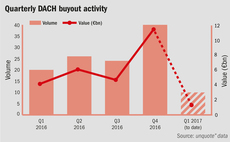

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

NorthEdge sells Fine Industries to Lianhetech in £103m deal

Trade sale of speciality chemicals business marks the GP's fourth exit in seven months

CM-CIC, Galia Gestion inject €5m into Adstellam

GPs provide funding to fuel the growth of the French point-of-sale software developer

Accent Equity sells Textilia to Danish trade buyer

Acquisition by De Forenede Dampvaskerier brings Textilia's private equity ownership to an end after 20 years

Omnes Capital sells Capcom stake to CM-CIC's Circet

Transaction marks first exit completed by Omnes from its Omnes Croissance 4 vehicle, coming two years after investment

21 Centrale Partners to acquire DL Software

French branch of pan-European GP 21 Partners intends to take the company private upon the deal's completion

Ardian sells Frostkrone to Emeram

French GP exits its stake in the German forzen foods manufacturer after a four-year holding period

KKR sells Winoa to KPS Capital Partners

KKR acquired steel abrasivesn producer Winoa in 2013 through a debt restructuring of the company