Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Caledonia hires Mills as investment manager

Alex Mills joins from Graphite Capital, where she spent two years as investment manager

GCP invests in Shorterm Group

GP has invested with capital drawn from its previously unannounced fourth vehicle

PM & Partners launches third vehicle

GP expects to hold a first close in H1 2017 for its latest vehicle, targeting €300m

MBO Partenaires raises €250m for fourth fund

GP completes record fundraising with its latest vehicle; the previous fund closed on €180m

In Profile: Mayfair Equity Partners

Managing partner Daniel Sasaki speaks to unquote" about the firm's maiden fundraise and building its investment and portfolio management teams

Idinvest et al. in €150m series-E round for Sigfox

Latest round brings total raised by startup to around €230m

Verlinvest buys 24.5% of Mutti

Investor will boost the company's internationalisation and is understood to target an IPO

PM & Partners sells Plastiape for c€150m

Following three-year holding period, the GP sold its stake in an aunction led by Baird and Banca Imi

Idinvest holds first close on €250m for Idinvest Growth Fund II

Fund's previous generation most recently took part in a €150m series-E for Sigfox

HTGF and Bayern Kapital in Mecuris seed round

Mecuris claims to operate in a €1.8bn market for prosthetics in Germany

Credo in £1.3m round for Cera

Funding round will support the launch of the London-based online social care platform

P101 holds €66.7m final close on first fund

Vehicle is now 60% invested as the GP eyes the launch of its second fund in 2017

NorthEdge appoints McQuaid and Holmes

McQuaid and Holmes join the firm's Leeds and Manchester teams from JLA Group and PwC respectively

Deal in Focus: Nordic Capital doubled Lindorff EV before merger

Managing partner Kristoffer Melinder speaks to unquoteт about the company's merger with its listed competitor

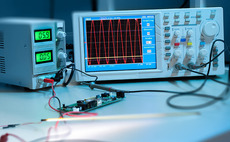

LDC exits Microlease to US competitor Electro Rent

Electro Rent is a portfolio company of American private equity firm Platinum Equity

Better Capital in exclusivity over £326m Gardner sale

Sale price would be above the figure sought for the aerospace company when it was first put up for sale

Ardian, Keensight, Parquest acquire Unither

Unither was acquired from a consortium of investors led by Equistone Partners Europe

Maj Invest sells KK Group to former Altor partners

Scandinavian investment firm Solix acquires the Danish wind turbine component maker

Warburg, General Atlantic sell 50% stake in Santander AM

Buyout firms Warburg Pincus and General Atlantic exit the asset after a three-year holding period

Omnes reaps 5x in Nomios exit to Waterland's Infradata

Omnes supported the group's management buyout in 2013 alongside Odyssee Ventures

Bridgepoint sells Oasis to Bupa for £835m

Sale of British private dental healthcare provider follows three-year holding period

HTGF in Filestage seed round

Germany-based VC High-Tech Gründerfonds usually invests €600,000 at the seed stage

IBB in €4.2m SearchInk round

IBB invested together with former Google engineering director Michael Schmitt

Ratos sets date and price range for Arcus IPO

Norwegian spirits group sets NOK 39-45 price range for shares ahead of 1 December listing