Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Beringea exits Fjord

Beringea has sold service design consultancy Fjord to management technology outsourcing and consulting service provider Accenture Interactive.

Graphite sells Dominion Gas to Praxair

Graphite Capital has sold Aberdeen-based oil field services company Dominion Gas to NYSE-listed Praxair.

Target Partners exits JouleX in $107m trade sale

Target Partners has sold its stake in IT energy management company JouleX Inc to US high-tech business Cisco.

TPG and VTB consider Lenta listing in London

TPG and VTB Capital are in talks with banks concerning a possible London listing of Russian supermarket chain Lenta.

Sun European halts sale of DBApparel

Sun European Partners has abandoned the attempted sale of DBApparel, the parent company of French underwear retailer Dim, due to a lack of sufficient offers for the business, according to French media.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

Catalyst Investors backs Reputation Institute

Catalyst Investors has completed a minority equity investment in Danish corporate reputation measurement firm Reputation Institute.

FF&P appoints Joy as senior adviser

International wealth manager Fleming Family & Partners (FF&P) has appointed Andrew Joy as a senior adviser.

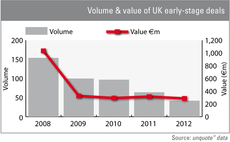

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

Industrifonden et al. back Flexenclosure

Industrifonden, Andra AP-fonden (AP2) and International Finance Corporation (IFC) have invested SEK 160m in Swedish information and communications technology infrastructure provider Flexenclosure.

Fountain Healthcare backs €9.2m Trino Therapeutics round

Fountain Healthcare Partners has invested in a тЌ9.2m series-A funding round for Ireland-based Trino Therapeutics Ltd, alongside British grant-giving body Wellcome Trust.

PineBridge's Calo joins Blackstone's Park Hill

Blackstone's placement agent division Park Hill Group has appointed Pablo Calo from PineBridge Investments.

Octopus leads £2.95m investment in Conversocial

Octopus has led a ТЃ2.95m investment round for social media management software company Conversocial.

Equistone reviews options for Allied Glass

Equistone has hired Rothschild to assess its options for Allied Glass, which could result in a sale later on this year.

Main Capital exits Iaso in trade sale

Main Capital Partners has exited Netherlands-based Iaso Backup Technology to US-based trade player GFI Software in a “double-digit-million-euro transaction”.

Prometheus in partial Pandora exit

Prometheus Invest ApS has agreed to sell 13 million shares in Pandora AS to institutional investors for DKK 2.6bn.

LDC backs MBO of Node4

LDC has backed the management buyout of UK-based IT and communications services provider Node4 Ltd.

Private equity tempted by Hotel Chocolat

Private equity houses are in talks with confectioner Hotel Chocolat regarding a possible purchase, which could see the company valued at around ТЃ100m.

British Gas leads £7m investment in 4energy

British Gas has led a ТЃ7m investment in 4energy alongside existing investors Environmental Technologies Fund (ETF), Carbon Trust Investments and Catapult Venture Managers.

Nazca buys Agromillora

Nazca Capital has acquired Spanish plant propagation firm Agromillora.

Enterprise closes Polish Enterprise Fund VII on €314m

CEE-focused GP Enterprise Investors has closed its latest fund, Polish Enterprise Fund VII (PEF VII), on €314m.

Axa PE and Fosun to acquire Club Med for €540m

Axa Private Equity and Fosun International have agreed to wholly acquire listed French holiday resorts group Club Méditerranée alongside the company's management for around €540m.

ACT et al. invest $5.2m in Cubic Telecom

ACT Venture Capital, Enterprise Ireland, TPS Investments and US telecoms giant Qualcomm have jointly invested $5.2m in Dublin-based global connectivity specialist Cubic Telecom.