Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

DBAG exits Coperion to US trade player

Deutsche Beteiligungs AG (DBAG) and its co-investment fund DBAG Fund V have sold German mechanical engineering group Coperion to US trade buyer Hillenbrand in a deal understood to be worth €400m.

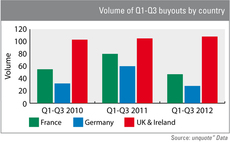

Data shows impact of continental crisis

Figures have outlined the extent to which the eurozone crisis, and other factors, have crippled the buyout market on the continent.

IK Investment Partners agrees acquisition of Vemedia

IK Investment Partners and CEO Yvan Vindevogel have agreed to acquire a majority stake in Belgian pharmaceuticals supplier Vemedia Pharma.

Mid Europa buys Alpha Medical from Penta

Mid Europa Partners has wholly acquired laboratory diagnostics provider Alpha Medical from Penta Investments.

Electra Partners hires investment manager

Electra Partners has hired ex-GCP Capital principal Ian Wood as an investment manager.

Advent acquires Danish KMD from EQT and ATP

Advent International has acquired Danish software solutions company KMD from EQT and ATP Private Equity Partners.

New investment bank launches in Paris

Sycomore Corporate Finance, a new investment bank set up by three French corporate financiers, launched in Paris in September.

PAI partners acquires Marcolin in €207m LBO

PAI partners has agreed to acquire a 78.39% stake in listed Italian eyewear manufacturer Marcolin at a price of €4.25 per share.

Fondo Strategico Italiano prepares bid for Ansaldo Energia

Fondo Strategico Italiano will make a non-binding offer to acquire around 30% of power plant construction business Ansaldo Energia, according to reports.

Index Ventures leads £8m funding for Secret Escapes

Index Ventures has led an ТЃ8m funding round for UK-based online luxury travel club Secret Escapes.

HIG Europe backs Vértice 360 Servicios Audiovisuales

HIG Europe has acquired a 49.99% stake in Spanish audiovisual group Vértice 360 Servicios Audiovisuales (VSA) for €16m.

Advent launches takeover offer for Douglas

Advent International has made a tender offer to acquire listed German perfume and books retail group Douglas, which would value the business at close to €1.5bn.

Naxicap takes majority stake in IMX France

Naxicap Partners is understood to have backed the management buyout of French delivery services company IMX France.

JC Flowers considers buying RBS assets

JC Flowers is reportedly considering a bid for 316 RBS branches worth up to ТЃ1bn.

Enterprise Ventures invests in Powelectrics

Enterprise Ventures (EV) has invested in UK-based sensors and telemetry business Powelectrics.

Palio plans £150m debt fund IPO

Debt fund Palio is planning an IPO to raise more than ТЃ150m for investment in debt opportunities for UK lower mid-market companies.

Cinven buys Amdipharm for £367m

Cinven has acquired UK-based pharmaceuticals business Amdipharm Group for ТЃ367m.

Enterprise Ventures backs LabelSneak

Enterprise Ventures has backed online men's fashion retailer LabelSneak with a ТЃ525,000 investment.

Earlybird sells BMEYE for €32.5m

Earlybird has sold Dutch medical diagnostics company BMEYE to Edwards Lifescience Corporation for €32.5m, reaping a 26% IRR on its investment.

Creathor Venture III holds final closing

German VC Creathor Venture has held a final close for its third fund on €80m.

PE-backed eFront acquires DMLT

eFront, a Francisco Partners-owned software provider targeting the alternative investment industry, has bought US-based DMLT.

Bain buys Telefónica unit for €1bn

Bain Capital has agreed to the acquisition of Atento, the call-centre unit of Spanish telecommunications giant Telefónica, for €1.04bn.

Carlyle awarded second extension for Chemring bid

Carlyle has been granted a second extension on its deadline to make an offer for British military supplier Chemring.

Oltre tackles the big issue

Social impact investing, where funds target opportunities which offer a social as well as financial return, are taking off in some parts of Europe. However, in Italy they are a rare sight. Amy King reports