Southern Europe

Tikehau, Unilever, Axa form EUR 1bn impact fund

Each party has made a EUR 100m commitment and the agriculture-focused fund is now open to new LPs

Schroders gears up for new VC fund-of-funds

Schroders Capital Private Equity Global Innovation Management XI has been registered in Luxembourg

Ergon holds EUR 800m final close for Fund V

New EUR 800m fund is almost 40% larger than its EUR 580m, 2018-vintage predecessor

Permira exits Althea to F2i and DWS

Deal will see the Italian group broken into two, with DWS owning the UK arm and F2i the Italian assets

Bregal Unternehmerkapital acquires Italgel

Specialty gelatine and collagen-based ingredients producer is the GP's second deal in Italy

Seaya launches EUR 300m sustainable venture capital fund

Seaya Andromeda held first close on EUR 130m backed by Iberdrola, Nortia and Fond-ICO Next Tech

Squire Patton Boggs makes France and Italy partner hires

Anthony Guillaume and Benjamin Marché join the Paris team, while Sara Belotti joins in Milan

Aksia and Alcedo in race for ready-meal producer Richetti

Italian company admitted a total of three parties to the second round of its KPMG-led auction

Alcedo exits Duplomatic in trade sale to Daikin Industries

Japanese group will pay EUR 220m for Italian valves and pumps maker, which saw revenues more than double since sponsor’s entry in 2017

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

Chequers weighs sale of textile chemicals maker Bozzetto

Sponsor will be advised by Lazard on the upcoming auction for the Italian producer of polymers and resins

Progressio exits Save the Duck to L'Occitane bosses

New owners pre-empted sale process for the Italian animal-free clothing brand; deals marks the second exit by Progressio’s Fund III

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

Alantra bolsters private debt team with new appointments

Hires include managing directors Alberto Pierotti and Jean-Philippe Lantrade

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Investindustrial sells Neolith to CVC VIII

During Investindustrial tenure Neolith posted EUR 145m in revenues in 2021 and an EBITDA CAGR of approximately 20%

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

Advent buys IRCA in SBO from Carlyle

Bakery ingredients firm has a reported EV of EUR 1bn and is expected to post 2022 EBITDA of EUR 75m

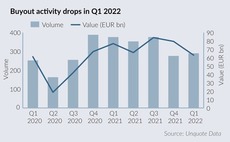

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

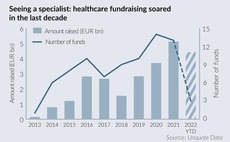

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

AP Moller, Biogroup among final bidders for Waypoint's Affidea

Final offers for the pan-European outpatient group are expected in a couple of weeks