Southern Europe

Southern Europe leads renaissance of billion-euro club

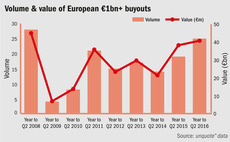

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

21 Investimenti sells Farnese to NB Renaissance

Wine-making business has increased its focus on exports and invested in new facilities

Spanish fundraising offers hope amid lacklustre dealflow

Spain’s private equity activity suffered from political uncertainty in H1 but nevertheless managed to attract its fair share of international dry powder

Glovo raises €5m series-A from Antai et al.

Backers include VC houses Caixa Capital Risc, Seaya, Bonsai, Entrée alongside private investors

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

Talde and Espiga back medical equipment producer Deltalab

Existing backer Talde, alongside new investor Espiga, will aim to boost the company expansion

Caixa in €1.3m round for Nanusens

Backers include Spanish venture capital house Inveready and high-net-worth individuals

Caixa Capital Risc leads €1m round for Nautal

Backers include Spanish business angels and several high-net-worth individuals

Permira's Higèa buys Biomedicale for €8.6m

Deal marks the 13th acquisition in the biomedical sector for the PE-backed group

Apax buys Italian maritime communication provider Telemar

GP intends to merge the business with its portfolio company Marlink

Cinven's Ergo buys Old Mutual Wealth Italy for €278m

Deal follows the GP’s expansion plan for its portfolio company Ergo Italia

Star Capital acquires 70% stake in GLM

Deal marks the fourth transaction for the GP’s Star III fund

Sator acquires additional 35% stake in L'Autre Chose

Following the transaction, the GP will own an 84% stake in the Italian company

Meridia buys Sosa Ingredients in maiden PE deal

GP deploys between €15-25m of equity for the acquisition, which will be its typical ticket

Black Toro II holds €160m second close

Black Toro hoped to hold a €200m close at the start of 2016 when it launched the fund last year

Deal in Focus: Ardian buys Dedalus for market consolidation

An in-depth look at Ardian's most recent investment in the Italian healthcare technology sector

Idea Capital holds €188.5m third close

Food- and agribusiness-dedicated vehicle launched in January 2015 with a €200m target

Wooptix raises €3m round from Bullnet Capital et al.

Backers include venture capital houses Intel Capital and Caixa Capital Risc

Altamar VIII holds final close on €500m hard-cap

Spanish funds-of-funds manager also launches a secondaries-focused vehicle

Aksìa, Alcedo sell Gimi to German corporate Freudenberg

Italian GPs sell their stake in home care goods manufacturer Gimi after an eight-year holding period

Miura buys 25% stake in Spanish fruit exporter Martinavarro

GP invested alongside several minority investors while funding families retain a controlling stake

ArchiMed buys Italian biotech business Micromed

Deal marks the GP's second transaction in the Italian healthcare sector since inception

Caixa Capital Risc leads $1m round for Codigames

Backers include Spanish venture capital firm Faraday Venture Partners, alongside existing investors

Three Hills holds €200m final close for second fund

Fund is managed by Three Hills in partnership with Swiss investment firm Decalia