Southern Europe leads renaissance of billion-euro club

The number of European buyouts valued at тЌ1bn or greater have soared to pre-crisis levels, with southern Europe leading the way. Vidur Sachdeva reports

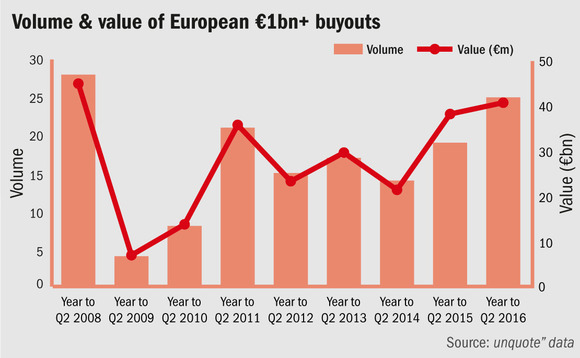

In the year to Q2 2016, the European buyout market recorded its highest deal volume in the €1bn+ category since the 12 months to Q2 2008, according to unquote" data. There were 25 such transactions in the 12-month period, representing the fourth highest aggregate volume on record behind the 12 months to Q2 2008 with 28, to Q2 2006 with 34, and to Q2 2007 with 55 mega-buyouts.

At €40.5bn, aggregate value within the billion-euro club remained 74.4% lower than the record of €158.1bn set during the year to Q2 2007. Still, the total represents a nine-year peak and an improvement of 6.6% as compared to the previous 12-months to Q2 2015.

Although the number of €1bn+ buyouts during the year to Q2 2016 were almost evenly split between the second half of 2015 (12 deals) and the first half of 2016 (13 deals), most of the larger deals were reported during the first half of 2016 (€26.3bn or 65%).

Southern Europe led the resurgence in €1bn+ deals and was home to eight such buyouts during the year to Q2 2016 – an all-time high for the region

Regionally, southern Europe led the resurgence after being home to eight €1bn+ buyouts during the year to Q2 2016 – an all-time high for the region. Two of these buyouts took place in Spain, while Malta was home to one, but it was Italy that stole the show and was largely responsible for the overall rise, accounting for five transactions. Encouragingly, these five Italian transactions belonged to a diverse set of sectors – consumer services, technology, financials and basic materials.

Four of these five deals were recorded in the first half of 2016, perhaps leaving many feeling optimistic about the state of affairs within the Italian private equity industry and hoping for a continuation of this trend into the second half of the year as well.

Besides Italy, the UK was also home to five €1bn+ buyouts, while France finished at a close third with four transactions. The Netherlands saw the largest buyout (with a disclosed value) during the period with LeasePlan changing hands for €3.7bn.

Analysing the data sector-wise, the industrial sector outpaced all other sectors after being home to 10 of the 25 €1bn+ buyouts in Europe, while consumer services came in at second place with seven transactions.

The following are the top five buyouts during the year to Q2 2016:

1. LeasePlan – July 2015; €3.7bn

London-headquartered GP TDR Capital, alongside a number of co-investors from Volkswagen and Fleet Investments, fully acquired Dutch fleet management business LeasePlan for around €3.7bn. The consortium of new backers included Dutch pension funds such as PGGM and ATP, Singapore's sovereign wealth fund GIC, Luxembourg-based Luxinva, and Goldman Sachs's merchant banking subsidiary, among others.

The consortium planned to finance LeasePlan's acquisition with an equity injection via the newco LP Group BV, representing approximately 50% of the €3.7bn purchase price, with the remainder consisting of debt facilities. The fresh capital will help LeasePlan pursue growth across the 32 countries in which it is currently active.

2. Autobahn Tank & Rast – August 2015; €3.5bn (est)

Allianz Capital Partners led a consortium of investors to acquire German motorway services operator Autobahn Tank & Rast, 10 years after selling the business to Terra Firma. Although the enterprise value for Tank & Rast was not disclosed, press reports placed it around the €3.5bn mark.

Should it be confirmed, the figure would represent a threefold increase on the price Terra Firma paid 10 years ago. It is understood Tank & Rast will target growth across its network via the launch of new service areas, the improvement of its existing facilities and the development of new product ranges and partnerships.

3. Nordic Aviation Capital – August 2015; €3bn

EQT acquired a majority stake in Nordic Aviation Capital, a Danish aircraft lessor, in a deal that valued the business at $3.3bn (or approximately €3bn). It was understood Nordic Aviation's chairperson and founder, Martin Møller, would continue to chair the business and remain a significant shareholder, contributing around 50% of the capital.

Kirkbi Invest, an investor in EQT's Fund VI, co-invested in the business alongside the GP. As of June 2015, Nordic Aviation had a net debt of $2.3bn and shareholders' equity of around $530m, according to EQT, who financed the transaction via its EQT VI vehicle.

4. Foncia Groupe – June 2016; €1.8bn

Bridgepoint and Eurazeo recently sold all their shares in French real estate group Foncia to Partners Group in a deal valued at €1.8bn. The deal, which was expected to be completed by September 2016, should bring exiting shareholders a 2.4x return on their original investment. Net proceeds after tax, transaction costs and acquisition debt repayment would amount to around €1.1bn, the GPs stated.

Since their investment in 2011, Foncia's annual revenues have grown by 4.4% and its average annual EBITDA by 11.3%. Overall, the group's EBITDA increased by 50%, moving from €86m in 2011 to €132m in 2015.

5. Euro Garages – October 2015; €1.8bn

TDR Capital acquired a minority stake in British petrol station forecourt retail operator Euro Garages, in a deal valuing the company at £1.3bn – approximately €1.8bn at the time. The deal saw founding brothers Mohsin and Zuber Issa remain at the helm of the company and retain a majority stake.

TDR's investment comes 18 months after it acquired Benelux- and France-based Israeli petrol-station operator Delek Europe in a €355m MBO, after which the company was renamed European Forecourt Retail Group (EFR). Media reports suggested that TDR would seek to merge Euro Garages and EFR ahead of an IPO on the US stock market.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds