Southern Europe

BlackRock eyes new Secondaries & Liquidity Solutions fund

Strategy makes global mid-market secondaries deals and provides liquidity at GP level

BC Partners preps Forno d'Asolo for upcoming sale

Auction of Italian frozen baked goods company is expected to launch in June

UCB, Ysios lead EUR 50m Series A for SpliceBio

Round for the gene therapy specialist is the largest ever Series A for a Spanish biotechnology company

Astorg closes Mid-Cap Fund on EUR 1.3bn

Fund will target EUR 150m-500m EV deals, expanding on Astorgтs current flagship strategy

Lightrock gears up for Climate Impact Fund

Impact investing GP raised USD 900m for its Lightrock Growth Fund I vehicle in 2021

Bain explores strategic options for Fedrigoni

Review of options for the Italian producer of speciality papers and self-adhesive labels could lead to a minority stake sale or an IPO

Henko Partners prepares to hit fundraising trail next year

Spanish GP will target EUR 140m-EUR 150m for new fund, with debut vehicle expected to be fully deployed by end-2023

Apax gears up for Fund XI

Apax Partners' USD 11bn predecessor flagship fund was 64% deployed as of September 2021

Livingstone hires Abad as new partner in Spain office

Eleuterio Abad will bolster the team in Spain and support activity and opportunities in the market

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

Investindustrial taps Bank of America, Baird for CEME auction

Sale documents for the fluid-control equipment maker are expected in March

BC Partners announces EUR 6.9bn fundraise for BC XI

Final close fell below the original target;Т GP expects to return to market for its next fund in H2 2023

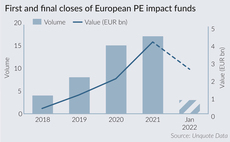

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Abac exits PronoKal to Nestlé Health Science for EUR 100m

GP first bought 100% of the share capital in 2017

HIG acquires screws and bolts distributor Berardi Bullonerie

The investment will support an acquisition strategy to accelerate growth

Access Capital registers ninth growth buyout fund

Fund-of-funds strategy makes primary and secondaries deals, backing funds investing in European SMEs

Coller to close USD 1.4bn debut credit secondaries fund

GP launched its first dedicated secondaries fund in May 2021 and has commitments from around 30 LPs

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

FSI buys 60% of Iccrea's digital payments arm at EUR 500m EV

Carve-out deal is the ninth investment from FSI I, which closed on EUR 1.4bn in February 2019 and is now 75% deployed

Softbank Vision Fund leads EUR 200m Series D for Paack

Paack, now valued at EUR 1bn, has pledged to be the first delivery service to be 100% emission-free

Planet First seeks sustainability investments ahead of EUR 350m fund close

Managing partner and co-founder FrУЉdУЉric de MУЉvius speaks to Unquote about the firm's evergreen fund and its investment strategy

Permira merges Kedrion, BPL

Combined biotechnology group will have more than EUR 1.1bn in revenues and 4,000 employees

Blossom holds USD 432m final close for third fund

VC will continue its focus on Series A investing in Europe, backing sectors including cryptocurrency