Southern Europe

Clessidra to launch €600m fourth fund

Fund will follow the same strategy as its predecessor, Clessidra Capital Partners III

Mediobanca, Russell Investments launch third private market fund

Fund invests in secondaries, distressed assets and opportunities in dislocated industrial sectors

Video: Cambridge Associates' Marcandalli on impact investing moving centre stage

In a new instalment of Unquote's Lockdown series, Annachiara Marcandalli explains why it is unlikely that coronavirus will sideline impact investing

Abante, Altamar to manage Mapfre fund-of-funds

Mapfre Private Equity is managed by Abante, while Altamar acts as investment adviser

Trilantic's Doppel bolts on Dietopack

Trilantic Europe said in a statement that its healthcare companies have made seven bolt-ons in 2020

Sherpa Special Situations III closes on €120m

Fund targets distressed companies based in Iberia and active across a wide variety of sectors

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

Ardian's Frulact buys Sensient's yoghurt division

With this add-on, Frulact expects to consolidate its market position and further expand in the US market

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

BlackRock and ApoBank launch healthcare fund

BlackRock-managed fund aims to give ApoBank's institutional clients access to healthcare investments

CVC in exclusivity for Genetic – report

Deal is expected to be signed by the beginning of August, says Mergermarket

Adara Ventures leads $5m round for CounterCraft

Round also sees participation from existing backers Evolution Equity Partners, Orza and Wayra

Tikehau to buy stake in Euro Group

Tikehau is investing in the energy transformation sector via its T2 Energy Transition Fund

Atomico leads $27m series-B for Onna

Glynn Capital takes part in the investment, alongside previous backers Dawn, Nauta and Slack Fund

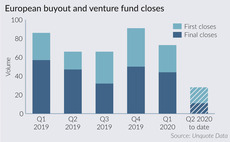

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Meta Change Capital launches €100m fund

Fund is dedicated to investments in blockchain companies across Europe, Asia, the Middle East and Africa

Vista-backed Accelya bolts on Farelogix

With this add-on, Accelya expects to further expand its end-to-end platform for the airline industry

Square buys VC-backed payment app Verse

Verse joins the Cash App division at Square and continues to operate as an independent business

Gradiente buys three companies, creates Argos Surface

GP deploys capital from Gradiente II, which held a final close on its €135m hard-cap in 2019

Asabys, BPI France, Ysios in €30m series-A for Ona Therapeutics

Company intends to use the financing to complete the pre-clinical trial of its lead candidate drug

Bain Capital, FSI to bid for Serie A – report

Bain Capital makes a €3.4bn preliminary offer for a 25% stake in Serie A, while FSI shows interest

Ubi Banca buys stake in Green Arrow Capital

This is the first financial investor that has entered the capital of the firm, owned by its founding partners

Vast majority of LPs satisfied with GP transparency – survey

Coller Capital's PE Barometer also reported LP concerns about forward-looking EBITDA add-backs

Xenon-backed Impresoft bolts on Progel

Following the deal, Progel's founders will stay on with the business and reinvest in the combined group