Southern Europe

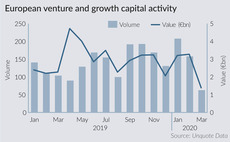

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

FVS launches €75m second fund

Fund targets minority stakes in companies based across the north-east of Italy, with revenues of €10-200m

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Riello Investimenti backs First Advisory

GP invests via its Italian Strategy Fund, a €150m vehicle that held a €50m first close in June 2019

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

OpCapita's Sebeto sells Ham Holy Burger

With this divestment, Sebeto intends to focus on its core pizza and pasta business

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

York Capital, Elements Capital buy Pillarstone-backed Famar

In addition to Famar Italia, the Italian subsidiary of Famar, the deal also includes Famar Properties

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

CVC to finance Deoleo capital increase

Restructuring agreement will reduce the company's current debt, amounting to €575m, to €242m

MJ Hudson Alma appoints Nigro as equity partner

Roberto Nigro will be based in Milan and focus on venture capital deals and transactions

Main Capital launches restructuring fund for Covid-19 crisis

Fund is dedicated to UTP exposures and is composed of a credit section and a finance unit

Generalitat Valenciana to launch €200m coronavirus fund

A private equity firm will be selected by the Institut Valencià de Finançes to manage the new vehicle

Ardian-backed Celli buys T&J Installations

Celli plans to consolidate its market position in the UK and further expand internationally

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

Coronavirus and private equity

All our latest coverage on the ongoing coronavirus crisis, and its impact on the European PE industry

Secondaries buyers expect 30% volume drop over next two months - research

Five out of 37 buyers still appear opportunistic and expect activity to go up

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors