UK / Ireland

Soho Square launches auction for Technical Fire Safety Group

Sellside adviser Rothschild has distributed information memoranda to prospective buyers

Inflexion acquires CDMO Upperton

The GP has invested in the British CDMO via its Enterprise Fund V

Volpi exits Version 1 to Partners Group

The Jefferies-led auction also saw Apax, OTTP, Cinven and Bain compete for the Irish IT solutions group

Lonsdale buys infrastructure consultancy Infrata

Deal for London-based firm marks the second investment made outside the GPтs buyout fund, which closed investment period last year

17Capital closes debut Credit Fund on EUR 2.6bn

Fund is the GP's first to focus on NAV financing in the form of credit, rather than preferred equity

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

Bowmark buys workflow automation provider WSD

GP will seek to expand London-based companyтs product development and grow in North America, Europe and Asia

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Hg bolsters team with promotions and new hires

GP has promoted three to partner and fills newly created role, head of talen

Melior Equity Partners holds EUR 160m final close for debut fund

Irish SME-focused GP is led by former Carlyle managing directors Jonathan Cosgrave and Peter Garvey

Briar Chemicals owner Aurelius launches sale process

Aurelius had previously gauged interest for the chemicals producer in 2019, Mergermarket reported

Carlyle acquires life sciences investor Abingworth

Deal follows EQT's acquisition of LSP in November 2021 as asset managers look for greater specialisation

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

Volpi hires Fairlie from Synova

Tech specialist closed its second fund in January 2021 and has made three hires this year

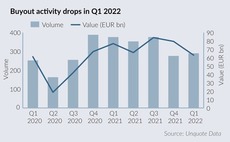

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

Novo-backed ReViral acquired by Pfizer

The British biotech company is also backed by CR-CP, New Leaf, Andera Partners, and OrbiMed, among others

Phoenix exits Forest Holidays for 3x money

Buyer is Sykes Holiday Cottages, a portfolio company of Vitruvian Partners and Livingbridge

H2 Equity exits premium logistics group Cadogan Tate to TSG

US sponsor plans to use acquisitions to expand the London-headquartered company abroad; management will retain minority stake

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Inflexion sells Marley for 3.5x, 58% IRR

Sale to listed construction firm Marshalls values the roofing tile specialist at GBP 535m

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

Dental Directory sees Exponent, Equistone bare teeth in sale second round

DC Advisory is expected to review final bids for the carve-out from Palamon-backed IDH Group in about a month

JamJar closes second fund on GBP 100m

JamJar Fund II is the consumer technology-focused first fund with institutional investor backing