UK / Ireland

Ashridge scores 1,439% IRR on Marclay after four-month hold

Ashridge invested in the UK-based cybersecurity and incident response firm in February

Montagu buys Waystone from MML

Acquisition of the fund advisory firm is Montagu's third SBO of 2021, according to Unquote Data

Investindustrial exits Polynt-Reichhold in buy-back

Asset was expected to fetch around тЌ2.5bn, with Lone Star previously thought to be in exclusivity

Unquote British Private Equity Awards 2021: entries due today

Submit your entry for the 2021 Unquote British Private Equity Awards before 5pm today

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

Livingbridge buys majority stake in VC-backed Semafone

Octopus Ventures and BGF exit the data security and compliance software developer

Five Arrows invests £120m in Causeway Technologies

Deal follows the GP's ТЃ300m SBO of Sygnature Discovery from Phoenix Equity Partners

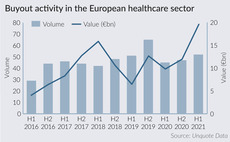

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

Bridgepoint mulls London listing

GP could be valued at ТЃ2bn and is also planning fundraises for its Europe and Growth strategies

Phoenix nets 4.3x return on sale of Rayner Surgical to CVC

CVC will deploy equity from its Fund VIII, which held a final close on ТЃ21.3bn

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Phoenix confirms Sygnature sale to Five Arrows

Deal is the third strong exit from Phoenix's 2016 fund, following Travel Chapter for 3.6x and Rayner for 4.3x

Hg, Vista Equity Partners to sell Allocate to trade

Sources told Mergermarket in May that the company could fetch a valuation of around ТЃ1bn

SoftBank leads $600m series-D for CMR Surgical

Series-D values the business at around $3bn, according to an FT report

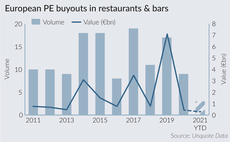

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Perwyn buys majority stake in JT's IoT division

Jersey Telecom will retain a minority stake in the company, which is valued at ТЃ200m

Graphite Capital sells Performance Timber to trade

Acquisition by Bergs Timber values the company at SEK 140m and ends a 12-year holding period

Epiris sells Saunderson House in £150m trade sale

GP acquired IFG Group in 2019, subsequently splitting it into Saunderson House and James Hay

Queen's Park Equity hires Manning from Livingbridge

Nick Manning spent two years at Livingbridge following stints at Arrowpoint Advisory and KPMG

GP Profile: Palatine looks to B2B, continued ESG value creation

Managing partner Gary Tipper discusses the firm's deal pipeline, its focus on ESG, and how its portfolio has weathered the pandemic

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

One Equity Partners acquires Brush Group

OEP has also supported Brush in its acquisition of electrical engineering company Aprenda

Squire Patton Boggs launches new funds practice in London

Steven Ward joins from Paul Hastings as partner in order to lead the new practice

Bridgepoint buys minority stake in Itsu

GP intends to back Itsu's growth plans after a challenging year for the restaurant and bar sector