UK / Ireland

Maven et al. invest £9m in HCS

Maven Capital Partners has backed the buy-in management buyout (BIMBO) of HCS Control Systems alongside the Simmons Parallel Energy Fund and Front Row Energy Partners.

Finance Wales injects £1.6m into Cardiff Aviation

Finance Wales has contributed £1.6m to a financing round for Cardiff Aviation Ltd, an aircraft maintenance and flight training organisation, in exchange for a 25% stake.

Amadeus backs Covestor

Amadeus Capital Partners has invested $12.75m in a series-B funding round for Covestor, a UK online investment marketplace, alongside existing investors.

Tax avoidance debate turns to private equity

Tax avoidance is top of the agenda for the G8 summit in Northern Ireland and part of that discussion will concern UK private equity’s treatment of corporation tax.

Index injects $11m into XO1 Ltd

Index Ventures has made an $11m capital commitment to XO1 Ltd, a new biotechnology company based in Hertfordshire.

Adveq to open London office

Swiss fund-of-funds Adveq is in the process of setting up a new office in London.

NVM supports CBio MBO

NVM Private Equity has invested £3m in the £4.4m management buyout of environmentally-friendly waste treatment business Cleveland Biotech (CBio).

LDC provides Forest Holidays with follow-on funding

Rural holiday accommodation provider Forest Holidays has opened its eighth site with follow-on funding from LDC.

Bridges sells The Gym Group to Phoenix

Bridges Ventures has sold a majority stake in The Gym Group to Phoenix Equity Partners, realising a 3.7x money multiple and a 50% IRR.

LGV’s Heywood steps down

LGV Capital CEO Ivan Heywood has stepped down and will be replaced by current managing directors Michael Mowlem and Bill Priestly.

Ingenious sells Digital Rights to Modern Times for £13.2m

Ingenious Media Active Capital (IMAC), a closed-ended investment company managed by Ingenious Ventures, has sold its stake in Digital Rights Group (DRG) to Swedish broadcaster Modern Times Group (MTG) for £13.2m.

Carlyle MDs Falézan and Colas to leave next year

Franck Falézan and Benoit Colas, two Carlyle managing directors with a focus on French buyouts, are set to step down in May next year.

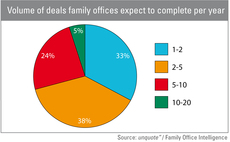

Family offices seek surge in deal origination

Family offices

Key Capital Partners’ Dwell close to administration

Furniture retailer chain Dwell could file for administration as early as this week, according to reports.

North West Fund backs Fourteen IP

The North West Fund for Venture Capital, managed by Enterprise Ventures, has committed £500,000 to communications solutions firm Fourteen IP.

Mobeus reaps 2x on BIH exit

Mobeus Equity Partners has divested the main operating facility of British International Helicopter Services (BIH) to trade player Patriot Aerospace Group, realising a 2x return.

MML-backed Arena makes Asian bolt-on

MML Capital-backed Arena has acquired Malaysia-based Asia Tent International.

Calculus hires new investment director

Richard Moore, Calculus Capital

UK private equity industry proves downturn resilience

UK private equity and venture capital funds generated a 6% 5-year IRR during the five years throughout the financial crisis, outperforming the 2.5% achieved by the FTSE All-Share, according to a recently published study.

NVM achieves 3.3x on IG exit

NVM Private Equity has sold IG Doors to the Hörmann Group, generating an IRR of 17.3% and a 3.3x money multiple.

Sovereign Capital appoints investment executive

Peter Shaw, Sovereign Capital

Dunedin backs £43m Trustmarque secondary buyout

Mid-market GP Dunedin has backed the £43m management buyout of Trustmarque Solutions, a technology services and solutions provider, from LDC.

unquote" Awards: Call for entries

UK Awards

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of £935m.