Healthcare

LSP et al. back Imcyse in €35m series-B

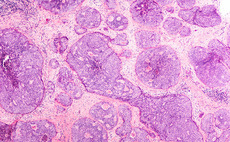

New and historical backers invest in Belgium-based Imcyse, a developer of immunotherapies

VC firms back €65m financing for BioSerenity

Fresh capital will be used to develop BioSerenity's products beyond their initial focus

Nordic Capital announces NY base for US healthcare push

Initiative is being led by healthcare co-head Raj Shah and healthcare partner Thomas Vetander

ADC Therapeutics gathers $76m in series-E extension

Headquartered in Lausanne, ADC Therapeutics has raised $531m since its inception in 2012

Corpfin-backed Grupo 5 sells six nursing homes to Korian

Partial exit for Corpfin, which bought a 98% stake in Grupo 5 in 2017 via its fourth fund

Advent backs Spanish dental group Vitaldent

GP intends to accelerate the company's organic growth and strengthen its market position

New opportunities flourish in Italian healthcare

Sector has seen intense activity in recent years, with a noticeable increase in both deal volume and value

Nazca buys biopharmaceutical company Diater in €45m deal

This is the fifth investment made by Nazca Fund IV, which closed on €275m in 2017

Investindustrial-backed Lifebrain buys clinical lab Galeno

Galeno will be integrated within the Lifebrain business and will consolidate its market position

Waterland-backed Rehacon bolts on Fysioconcept

Waterland acquired a majority stake in physiotherapy provider Rehacon in January 2019

Duke Street backs MBO of Kent and Athlone from DCC

UK and Irish businesses will form the basis for a buy-and-build growth strategy

CVC-backed Synsam postpones IPO – reports

CVC acquired the business in 2014, drawing equity from CVC European Equity Partners V

Ampersand to acquire Vibalogics

Ampersand typically invests $10-50m in companies with $10-100m in annual revenues

Steadfast Capital to buy W Söhngen

Steadfast will use its fourth vehicle for the investment in the medicine products manufacturer

Livingbridge exits Create Fertility in management buy-back

Sale ends a six-year holding period for the GP, which invested ТЃ5m in the company for a minority

Seventure Partners invests €3.5m in Domain Therapeutics

Paris-based VC typically provides up to €20m per company, from early to late stage

Creandum leads £10m series-A for life insurance app Yulife

MMC Ventures, Notion Capital, LocalGlobe and Anthemis Ventures also take part in the round

Ekkio backs Mediliant

Mediliant is the fourth investment completed via Ekkio Capital IV, closed in May 2018

Ardian acquires Sintetica

In 2018, Sintetica reported revenues of CHF 75m, up from approximately CHF 60m in 2017

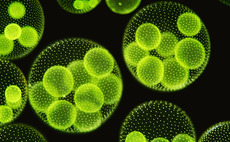

TA Associates' Solabia Group buys Algatech

TA has been a minority investor in natural active ingredients manufacturer Solabia since 2018

ArchiMed carves out Diesse from PZ Cormay

Diesse was acquired from Orphée, the Swiss subsidiary of Warsaw-listed diagnostics group PZ Cormay

Sofinnova closes MD Start III Fund on €48m

MD Start, which is a group of three funds, was started by Sofinnova Partners in 2010

VCs invest £14m in Storm Therapeutics

Storm Therapeutics has now raised more than ТЃ30m in capital from its new and existing investors

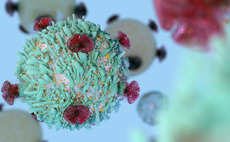

Syncona leads £35m series-A for Quell

UCL Technology Fund also took part in the round for the newly launched cell therapy company