Industrials

Gimv sells Brakel via trade sale

Gimv sells natural climate control and fire safety specialist Brakel to Kingspan

IK sells SVT Group to Ergon Capital

Ergon drew capital from its 2010-vintage €775m buyout fund to support the transaction

IK exits Ramudden to Triton

Transaction ends three-year holding period for IK, which acquired Ramudden in April 2014

Silverfleet sells CCC to Ardian

Management team, headed by Christian Legat, take a significant stake and remain in their roles

BPI France and French armed forces ministry launch fund

French armed forces ministry and state-backed BPI France launch the €50m Definvest fund

CD&R to buy 40% stake in Belron group

Clayton Dubilier & Rice plans to acquire 40% of vehicle glass repair provider Belron

Rubicon and Grovepoint support buyout of John Lawrie

Oilfield decommissioning and metal recycling company will look to expand across the UK and US

Partech leads €10m series-A for Shippeo

Existing investor Otium Venture also takes part in the latest round of financing

Paragon, Gimv team up on Wemas buyout

Paragon's involvement is announced eight weeks after Gimv's initial buyout

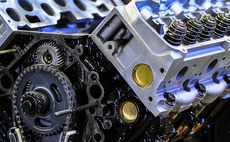

Wise's Tatuus acquires Autotecnica Motori

GP acquired Italian racing cars chassis producer Tatuus Racing in February 2017

Ardian's Italmatch bolts on Detrex

Offer values the listed US target at $42.5m, based on the offer price of $27 per share

H2 Equity Partners backs One Way Plastics

GP secures a majority stake in the Dutch disposable plastic bags developer

Omers PE to acquire Trescal in SBO

GP is in talks to buy French calibration services specialist Trescal from Ardian

Capital Partners to sell Gekoplast to K-Holding

K-Holding intends to wholly acquire reusable packaging business Gekoplast before 30 November

Paragon carves out Condecta from Arbonia

Arbonia announced it would sell Condecta in July 2017 after a strategic review

Triton-backed Akeab bolts on Kewab

Triton acquired Akeab in June 2017 from Swedish investor Priveq's Investment Fund IV

BPI France sells MR Cartonnage Numérique to trade

Diam International buys French packaging producer MR Cartonnage Numérique from BPI France

Star Capital exit Codyeco via trade sale

GP exits its 95% stake in the Italian dyes business after a four-year holding period

Aliter-backed Edwin James buys PEME

Aliter draws equity from its maiden ТЃ92m fund, Aliter Capital I, to finance the deal

Lone Star buys Stark Group in €1bn deal

US-based GP acquires the building materials distributor on a debt-free and cash-free basis

Astorg's Parkeon to bolt on Cale

French parking services provider Parkeon starts talks to acquire Sweden-based Cale

Alpha Private Equity buys Ipcom from Waterland

Acquirer uses Alpha Private Equity Fund 7, which closed on €903m earlier this year, to fund the acquisition

Cairngorm secures majority stake in Thornbridge Sawmills

Deal is the first for the Cairngorm Capital II fund, which closed in April 2017

Rutland reaps 2.6x on £69m sale of Brandon Hire to VP

GP was invested in the UK-based tool and equipment rental company via its second fund