Sector

Novartis, Columbus et al. in €37.5m series-A round for Vivet

Other investors in the round include Roche Venture Fund, HealthCap, Kurma Partners and Ysios Capital

EQT's Getec acquires Urbana

EQT's portfolio company strengthens its presence in the northern Germany energy sector

Nova Capital sells DirectorBank in management buy-back

Sale of executive recruitment firm brings to an end an 11-year tenure for the GP

Finlab and Coparion back Fastbill

Extra capital will be used to support the company's growth by expanding the financial platform

BIVF at al. lead €20m series-A for ImCheck Therapeutics

Backers include Kurma Partners, Idinvest, Gimv and Life Sciences Partners

HTGF sells Collinor to Godesys

Medium-term goal of the acquisition is to integrate Collinor's software into Godesys's project management systems

OxfordCapital and Episode 1 lead $3.1m round for Attest

Market research platform will use the funding to launch its product, and invest in product development

EQT acquires Open Systems

According to a regulatory filing, the GP will take full control of the target indirectly using a holding company

Vendep Capital hits €40m close for second venture fund

GP aims to support pre-series-A fundraising for Finnish software developers

Elaia Partners holds €115m first close for latest fund

French VC has already made five investments via its latest vehicle, Elaia Delta Fund

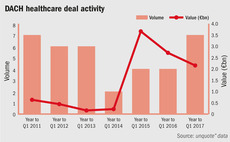

Shot in the arm for DACH healthcare market

Consolidation opportunities in the mid-market fuel increased investment from private equity, with aggregate volume reaching a six-year high

Advent's Ammeraal Beltech bolts on F&P

Dutch business acquires its Dublin-based competitor to expand across the Irish market

Oakley acquires Plesk in £105m EV deal

GP invests in web administration business with capital drawn from its 2017-vintage тЌ750m fund

DBAG sells Romaco to Truking Group

DBAG will initially sell around 75% of the company from its balance sheet and its vehicle DBAG Fund V

Omnes backs Batiweb SBO

French GP secures a minority stake in the business while Ardian realises its 2008 investment

Intera-backed Kamux to float at 680-800 cents per share

Preliminary price range would put the company's market cap at тЌ253-297m, with 10.1 million existing shares being sold

Disruptive Capital acquires majority stake in REG for £8m

Deal values the insurance-related software company at ТЃ20m and will fund international expansion

Style Capital buys Italian fashion house Forte Forte

Fashion-dedicated GP acquires a majority stake in the business from the Forte family

CVC buys 80% stake in Breitling

Director Théodore Schneider will reinvest alongside CVC to retain a 20% stake in the company

Eurazeo sells Colisée to IK Investment Partners

Sale follows a three-year tenure and reportedly values the care home operator at €236m

Wise sells chemicals producer Primat

Following a three-year holding period, the GP sells its stake to a consortium led by Hat Orizzonte

Bitkraft holds €18m first close for eSport venture fund

Fund is targeting a final close on €30m and has already invested in 10 eSport companies

BC Partners makes full exit from Com Hem in SEK 3.7bn sale

Sale was agreed at a price of SEK 110 per share and will be a final exit for BC Partners

Warburg Pincus sells Source to Invesco

Previous media reports suggested the vendor was looking for a $400-500m valuation for the asset manager