Sector

Gimv buys minority stake in Projective Group

Digitalisation consultancy and recruitment business intends to pursue a buy-and-build strategy

Meridia exits food ingredients producer Sosa

This is the second exit inked by the GP's debut fund, Meridia Private Equity I, following the sale of KIpenzi

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

Paragon-backed Apontis Pharma sets IPO price range

Shares are priced at €18.5-24.5, with a final pricing expected on 6 May before the 11 May listing

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

Corpfin sells Secna to EQT's Chr Hansen

Sale ends a six-year holding period for Corpfin, which bought a 51% stake in the company via its €255m fund IV

Permira buys minority stake in New Immo Group

Existing investor Qualium Investissement is to retain a stake in the digital real estate platform

MessageBird raises $800m series-C extension

The $1bn funding is reportedly Europe's largest ever series-C round

Bain Capital, JC Flowers back Co-operative Bank

Bain Capital and JC Flowers become investors in the bank alongside its five other current financial sponsors

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

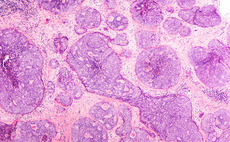

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Bain sells Fedrigoni's security business to Epiris's Portals

Sale comprises Fedrigoni's facilities specialised in the production of security paper for banknotes and documents

Lumos leads €70m series-C round for OpenClassrooms

Education technology company also attracts Salesforce Ventures, Chan Zuckerberg Initiative and GSV Ventures

Arcline buys PTS from Columbus

Arcline intends to boost PTS's growth through the expansion of its production and its technology portfolio

Corten buys Emeram's Matrix42

SBO of the digital workspace software is Corten's first investment from its €392m debut fund

Softbank leads $225m series-D round for Exscientia

Japanese investor provided additional $300m equity commitment that can be drawn at the company's discretion

Metrika buys machinery business Robor

This is the second deal made by Metrika I fund, which targets Italian companies generating revenues of €20-100m

Capza exits Ivnosys to PSG-backed Signaturit

Sale ends a two-year holding period for Capza, which acquired a 40% stake in the business via Capzanine 4 Flex Equity

Gilde Healthcare buys Acti-Med

Deal is the fourth platform investment from the GP's €200m Gilde Healthcare Services III fund

CPPIB, Fidelity lead €262m series-D round for Kry

Company was founded six years ago and has so far raised nearly тЌ500m over five rounds

Capiton, Nord Holding sell Engelmann Sensor to DPE

Smart meter business is the final portfolio company in Capiton's 2010-vintage fourth fund

Telemos Capital acquires Mammut

Conzzeta began to explore sale options for the Swiss outdoor clothing and hardware brand in 2019

Alto-backed CEI buys Lema

Combined group expects to reach revenues of €85m in 2021, with a 20% EBITDA margin