Sector

Ardian sells Lagarrigue to Naxicap

Sale ends a five-year holding period for Ardian, which bought a majority stake in Lagarrigue from Azulis Capital

Maguar Capital invests in Bregal-backed STP

Maguar partner Gunther Thies founded STP; partner Arno Poschik was on STP's board during his time at Hg

Triton acquires Geia Food from Credo Partners

Credo exits the company after acquiring a 55% stake in Geia in 2017

Levine Leichtman backs Prime Global

This is the fifth investment made by Levine Leichtman Capital Partners Europe II, which closed on тЌ463m in 2020

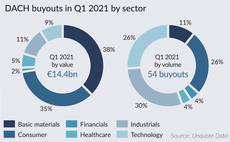

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

KKR sells minority stake in Hensoldt

Leonardo is to buy the 25.1% stake for €606m; KKR will retain an 18% stake in the sensor developer

Clessidra's Botter bolts on Mondodelvino

Combined group expects to reach revenues of €350m in 2020 and further expand its market share

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Eurazeo invests €410m in Aroma-Zone

Following the deal, the founding Vausselin family retains a significant minority stake in the business

Inflexion and Informa combine FBX, Novantas

Inflexion and Novantas will each own a minority stake in the newly formed financial data business

MBO exits public relations specialist LLYC

Sale ends a six-year holding period for MBO, which invested €6.35m in the business in exchange for a minority stake

DevCo acquires minority stake in Bluefors

GP is deploying equity from DevCo Partners III, which raised тЌ180m at the end of 2019

Egeria acquires NIBC-backed Fletcher Hotels

NIBC backed Fletcher's 2016 MBO; Fletcher plans to grow from 103 to 150 hotels in the coming years

Prosus, Tencent lead $80m round for Bux

ABN Amro, Citius, Optiver and Endeit take part in the round, alongside previous backers HV Capital and Velocity

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

KKR leads €100m series-C for Ornikar

Existing investors Idinvest, BPI, Elaia, Brighteye and H14 also took part in the fundraising

Eurazeo to buy Aroma Zone for €700m – report

Company's sale attracts several buyers, including private equity firms Ardian, Bain Capital and CVC, according to reports

Paragon acquires Bregal's Sovendus

Bregal acquired a minority stake in the e-commerce customer reward platform in 2015

SHS sells stake in Medigroba to trade

Medical homecare provider Medigroba received significant inbound interest from strategic buyers

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

MusicMagpie lists in £208m IPO, NVM reaps 12x return

NVM generates proceeds of ТЃ72.5m from the exit and retains a 16.1% holding worth ТЃ33.4m

F&P4Biz buys fuel tanks specialist Farma

F&P4Biz intends to boost Farma's international expansion, while pursuing a buy-and-build strategy

Paragon-backed Apontis Pharma announces IPO intention

Paragon acquired the pharmaceutical business from its parent company UCB in 2018 via Paragon II