Technology

Astorg, Bridgepoint buy Fenergo from Insight Partners

Media report values the business at $1.16bn, with the two GPs buying their stake for $600m

Gro-backed Trifork to list in €400m IPO

Planned exit comes six years after software investor Gro Capital invested €6m in Trifork for a 20% stake

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

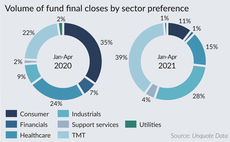

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Sentica exits Finnish IT company Solteq

Exit comes 11 years after the GP, via Sentica Buyout III, invested in Descom, which was acquired by Solteq in 2015

Abénex backs medical imaging software provider EDL

GP plans to support the company in boosting its organic growth and accelerating its expansion through targeted add-ons

FSN acquires Omegapoint from Priveq

Priveq exits the company four years after acquiring a 40% stake

Eurazeo invests in I-Tracing in €165m deal, Keensight exits

Following the deal, Sagard NewGen invests as a minority shareholder in a holding company controlled by Eurazeo

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

Keensight sells LinkByNet to Accenture

Deal ends a five-year holding period for Keensight, which invested €50m in LinkByNet in exchange for a minority stake

Equistone buys majority stake in TimeToAct

Germany-based IT consultancy is to be Equistone's fourth platform investment of 2021

Advent leads $220m series-D for Shift at $1bn valuation

Avenir, Accel, Bessemer Venture Partners, General Catalyst and Iris Capital also take part in the round

Sovereign invests in AquaQ Analytics

GP is currently on the road for Sovereign Capital V with a ТЃ450-500m target, as reported by Unquote

CVC leads growth investment in Acronis

Cybersecurity software developer is valued at $2.5bn, compared with $1bn at its last funding round in 2019

Seco floats in €397m IPO

Sellers include FII, which owns a stake in Seco via its Fitec fund, and the company's founders

Amadeus V Technology Fund closes on £110m

Fund invests in seed and series-A startups specialised in science and engineering-led innovation

Hg sells EidosMedia to Capza

Sale ends a six-year holding period for Hg, which acquired a majority stake in Eidosmedia firms Wise and Aksia

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

Permira buys minority stake in New Immo Group

Existing investor Qualium Investissement is to retain a stake in the digital real estate platform

MessageBird raises $800m series-C extension

The $1bn funding is reportedly Europe's largest ever series-C round

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

Lumos leads €70m series-C round for OpenClassrooms

Education technology company also attracts Salesforce Ventures, Chan Zuckerberg Initiative and GSV Ventures