DACH exit rebound expected in H2 2021

While recent months have presented unique logistical problems for sponsors looking to sell portfolio companies, as well as for parties looking to buy them, market players are gearing up for a rebound in exit closings in the second half of 2021. Harriet Matthews reports

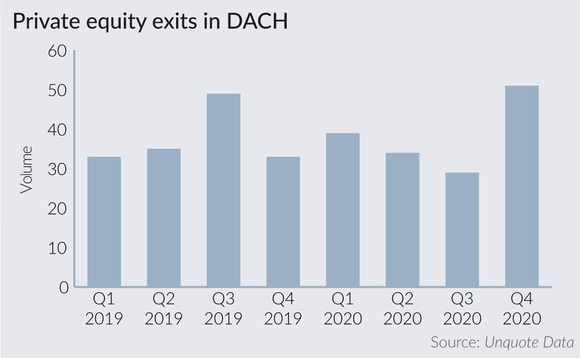

According to Unquote Data, DACH private equity players completed 16 exits in January 2021, compared with 14 in December 2020, demonstrating that exit dealflow is continuing to recover from its low point in Q3 2020. Indeed, the volume of exits recorded in the DACH region remained almost identical in 2020 compared with 2019, as did the composition of the sectors in which these deals took place.

Exit planning is continuing in spite of the macroeconomic damage wrought by the pandemic. "M&A is not opportunistic, it is strategic," says Andre Waßmann, a member of the executive board at Helbling Business Advisors. "These projects have a certain duration, which is usually 6-12 months. The deals taking place now are closings that could have been decided on at the start of last year. So we might only see an effect of the decisions happening now next year. Exit decisions are about the anticipation of what will come – for example, if prices will shrink, or if sufficient interested parties will be interested."

The ability to anticipate how and if coronavirus restrictions will continue to affect travel is key to making decisions. "The second lockdown in November was a bit of a surprise for everyone," says Stefan Jaecker, CEO of DC Advisory in Germany and Poland, "and the market dynamic received a bit of a push-back, but a lot of companies are now preparing exits on the back of the vaccine being available and a brighter summer."

"To my mind, the time when we will get back to former deal volumes will probably be in H2 2021," says Waßmann. "That does not mean there is no activity right now, though – there is intensive preparation, with sponsors looking at their portfolios, looking at whether they are at the end of the lifecycle, what the current investment strategy is, what the liquidity is and if there are sufficient funds."

Unquote sister publication Mergermarket reported in December 2020 that Ufenau had mandated Stifel for the sale of Swiss IT Security, with the deal expected to take place after the company has completed more add-ons in its buy-and-build strategy. In February 2021, Mergermarket reported that Astorg is looking to sell industrial software business AutoForm in H2 2021 in a deal that could be valued at €1bn, based on a 15x entry multiple. Other sponsor-backed businesses currently in the market include BID Equity's social care software platform Myneva and Bregal-backed online marketing business Sovendus, according to Mergermarket.

Recovery and resilience

"Where capital will flow is the areas that drive digitalisation," says Waßmann, highlighting an area of interest for both corporates and sponsors. "We've seen that having a digital structure helps, and this will now be mandatory – many companies have started and even already finished this transformation during the pandemic, which will drive M&A."

Although prospects look good for sponsors that own businesses operating in sectors regarded as resilient to the impact of coronavirus lockdowns, potential buyers will also expect to see recovery stories. "It's no longer just about resilient businesses now, but also models that are recovering out of the Covid-19 situation," says Jaecker. "We are seeing this dynamic in the automotive sector, for example, where there are two types of companies. Firstly, there are the ones suffering from overall industry challenges and Covid; and secondly, the ones who already had a good business model addressing the challenges in the industry itself, such as the shift from combustion to electric. Deals are coming back to the market that show a clear recovery of these business models."

However, exits in sectors that have been significantly damaged, such as leisure or travel and tourism, could also present opportunities – and not just for traditional distressed players. "Some non-distressed PE firms have set up vehicles, or at least teams, to screen the market and find a consolidation roadmap, as there is a great understanding and belief that the market will come back," says Jaecker.

Changing corporate strategies and the importance of digitalisation could also affect the landscape of potential buyers, notes Waßmann. "We typically try to draw a picture of the entire market and who might be interested in a certain business – we don't look into industries as a restriction as we believe these borders are fading away, it's more about mega-trends and applying solutions. For example, if we are looking for investors who might be interested in a technology for solving an end customer problem, it might be companies from a completely different industry, since the investor might want to diversify."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds