DACH unquote

Consortium of VCs exit Indoo.rs

Speedinvest, Tecnet Equity and Techinvest backed Indoo.rs across four venture and seed rounds

Aberdeen Standard Investments, DIF acquire Unitank

Two investors wholly acquire the oil storage business, each taking a 50% stake for an undisclosed sum

Invision closes sixth flagship fund on €375m

Invision VI's predecessor, Invision V, closed on €285m and has made its final acquisition

Redmile Group invests in Hookipa's €33.2m series-D

Hookipa's previous investors include Sofinnova Partners, Takeda Ventures and Forbion

Syncona leads CHF 35m series-A for Anaveon

Anaveon initially received seed funding from the UZH Life Sciences Fund and BaseLaunch

UVC, BtoV lead €10m series-A for I2x

HV Holtzbrinck Ventures and new investors MS&AD Ventures and Asgard also take part

KKR acquires Universum Film

Fred Kogel, CEO of the independent audiovisual content platform, has hired Markus Frerker as COO

AnaCap-backed Heidelpay bolts on Alpha-Cash

Alpha-Cash is Heidelpay's second acquisition in 2019 and its fifth since Anacap's first investment

Ambienta-backed Safim bolts on Omni

GP intends to strengthen Safim’s position within the DACH market with the bolt-on

Triton and ADIA carve out IFCO in $2.51bn deal

Triton and Abu Dhabi sovereign wealth fund buy IFCO plastic containers business from Brambles

KKR buys TMG

GP is bringing in media entrepreneur Fred Kogel as CEO while Herbert Kloiber joins the advisory board

Nauta Capital leads $6m round for German startup Zenloop

Piton Capital also takes part in the funding, alongside entrepreneurs including Christian Henschel

Capvis sells Rena to Equistone

Management team led by CEO Peter Schneidewind will become shareholders alongside Equistone

Ardian buys stake in SwanCap Partners from UniCredit

SwanCap combines primary investments, direct secondaries and direct co-investments

Halder makes first investment from new fund

Halder VI held a final close in January, but no further details were released by the firm

Auctus sells Valantic to DPE

Founding shareholders and management, led by Holder von Daniels, retain a stake of approximately 25%

Palamon announces roll-over investment into Ober Scharrer

GP sold Ober Scharrer to Nordic last year, generating a 3.6x return on its original investment

Gain Capital holds €28.4m first close for third fund-of-funds

Vehicle has a target of €60m and will look to hold a final close by the end of 2019

Bessemer leads €30m round for Mambu

Acton Capital, CommerzVentures, Point Nine Capital and Runa Capital also take part

PG Impact Investments holds $210m final close

Firm is independent but has access to Partners Group’s infrastructure, expertise and resources

XAnge invests in Sunacare

XAnge makes early-stage investments of €500,000-8m in French and German companies

Strong LP appetite and creative credit to fuel DACH growth

Despite stiff competition for assets, PE firms in the DACH region hit record deal volume in 2018 and expect further growth in 2019

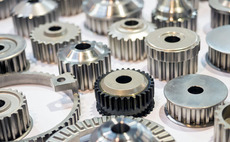

VC firms back €4m series-A for Kreatize

Fresh capital will be used to expand the platform and improve data evaluation methods

B-to-v holds second close for Industrial Technologies Fund on €80m

Fund held its first close in March 2018 and is expected to have a final close in mid-2019