Germany quiets down in Q4

After a substantial increase in deal activity in Q3, the German private equity market grew quieter again towards the end of 2012.

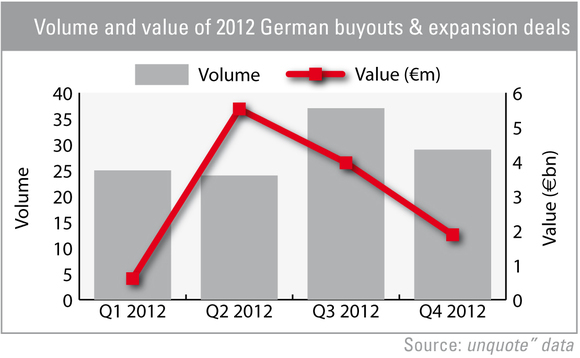

As many parts of Europe, the year had started off rather slowly in Germany. Q2, however, saw a surge in value, going from only €612m between January and March to more than €5bn in the following three months. Q3 led on with more deals, increasing the country's transaction count by 37 buyouts and expansions, although overall value didn't follow the same upwards trajectory.

In Q4, however, European activity slowed down significantly – and Germany wasn't spared. German dealflow slowed down to 29 transaction again, with only €1.9bn spent.

The most active sector in the fourth quarter was software, recording seven deals, followed by business support services with three transactions. Software has been one of the busiest segments in terms of both deals and exits across Europe this year, so its prevalence in the statistics is not surprising.

2013 could be another slow year for the European market. Yet, some investors are confident that deal activity in Germany will increase, piggy-backing on the country's relatively strong export-driven economy.

Look out for more Q4 activity figures in the upcoming unquote" Private Equity Barometer, published later this week in association with Arle Capital Partners.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds