Nordic buyout deal volume peaks in H1 2021

The Nordic region was abuzz with buyout activity in H1, as deal-making processes resumed and pandemic uncertainty gave way to an unprecedented number of deals.

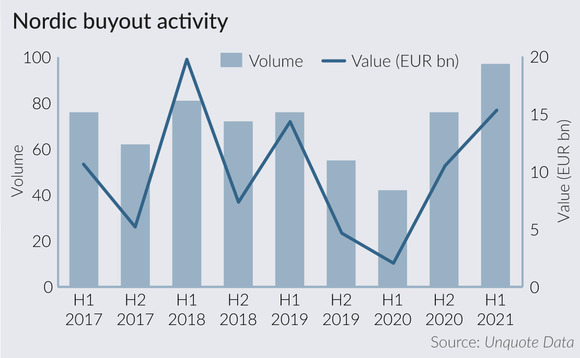

Buyout deal volume in the Nordic region reached its highest level in the first half of 2021, with preliminary figures from Unquote Data recording 97 deals in the region. The figure is already equivalent to 80% of all buyouts that took place in the region over the whole of 2020, and more than double the 42 buyouts recorded in H1 last year. Dealflow was up by 25% when compared to H1 2019, 19% compared to H1 2018, and 25% compared to H1 2017.

The aggregate deal value of H1 2021 deals amounts to an estimated EUR 15.3bn, which is already higher than the total of EUR 12.6bn seen over the whole of 2020.

At first glance, H1 2021's aggregate value is some way off the record EUR 19.7bn seen in the first half of 2018. However, H1 2018 saw the €7bn Sivantos/Widex deal by EQT, as well as the completion of the EUR 4.5bn take-private of Nets by Hellman & Friedman. By comparison, the 2021 deal with the highest disclosed value was the EUR 2.5bn buyout of Danish heavy building materials distributor Stark Group by CVC (although the joint buyout of Finnish electricity distributor Caruna by KKR and OTPP is thought to have been valued at several billion euros as well).

Meanwhile, H1 2021 activity in the core mid-market (here comprising deals valued between EUR 50m and EUR 500m, and less easily skewed by one-off mega-deals) was the highest ever recorded by Unquote in a half-year. The 42 deals worth EUR 5.5bn marked an increase of 90% and 61% respectively on the figures seen in H2 2020.

Denmark has been the main engine of buyout activity so far this year with 34% of the deals taking place in the country, followed by Sweden (29%), Norway (20%) and Finland (16%).

Breaking down the activity in terms of sectors, industrials made up the largest chunk of deal volume by a small margin, with 30 out of the 95 buyout deals, closely followed by technology, which recorded 26 buyouts, and consumer goods and services, which together saw 26 deals.

More statistical analysis of H1 2021 activity will be available on Unquote in the coming days, including the release of the full Q2 2021 Private Equity Barometer.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds