Strategics pull back from PE sales as macro uncertainty bites

Sponsors exiting portfolio companies in Europe this year have been unable to count so much on the appetite of strategic players.

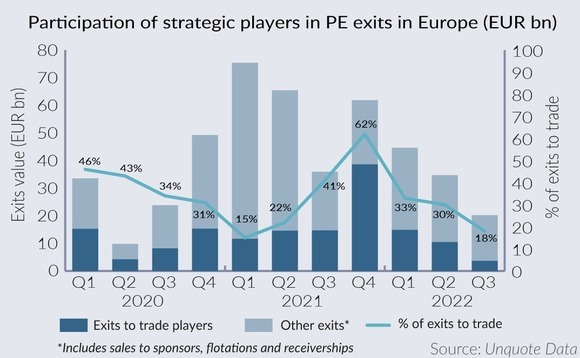

While less than a year ago cash-rich corporates were taking the lion's share of sales of PE-backed business amid a red-hot M&A market, the participation of trade players in sponsors' exits has been dropping throughout 2022, reaching its lowest point in three years in the last quarter, Unquote Data shows.

In Q3 2022, strategics acquired 46 of out 135 private equity sales, which in terms of disclosed valued translated into EUR 3.6bn out of a total of EUR 20.6bn in transactions – a share of just around 18% of the value of exits in the period. This is a dramatic decline compared to the same quarter last year when trades were responsible for 158 out of 333 exits, or EUR 14.6bn out of EUR 35.9bn of deal value – a 40% share.

"Companies are now preparing for a high inflation and lower growth environment, with less cash in hand for M&A," said Sunaina Sinha Haldea, global head of private capital advisory at Raymond James. "This is why we are seeing strategic fallback in acquisitions, as they shore up their balance sheet for an uncertain economic period ahead."

Corporates had been expected to snipe in on PE assets at a time when volatility in capital markets has left funds unable to float portfolio assets, while difficulties in underwriting debt have shrunk the pool of secondary buyers.

At the same time, PE buyouts are at their lowest point since the COVID-19 outbreak all but closed deal markets, with just EUR 44.6bn deployed in 2Q – a 47% plunge compared to the prior quarter. This follows a trend of fewer GPs bringing assets to auction amid a valuation expectation gap, leaving a smaller pool of companies to buy.

Still, some trade players are bucking the trend, showing that corporate appetite is still there for assets seen as good strategic fits. Just last month, Nordic Capital sold UK-based specialty diagnostic platform The Binding Site to Thermo Fisher for GBP 2.25bn at a 19x return after 11 years of ownership. In the mid-market, Sun European sold Allied Glass French strategic Verallia after just three years.

Chance to pounce

A disrupted M&A market however could shortly start creating more opportunities for corporates, as PE firms dull their competitive edge while they wait for interest rates to stabilise.

Although financial sponsors still have record levels of dry powder to deploy, many are facing fundraising headwinds amid an LP capital crunch, meaning they could start investing more cautiously. That dynamic has also shifted the power balance to LPs, with some pressuring GPs to avoid overpaying and engage in more complex co-investment equity syndicates, which could leave space for strategics to move faster.

"Trade buyers have in recent years been typically unable or unwilling to move at the pace of their financial sponsor counterparts, so the current market headwinds are helping to level the playing field for them," said Ben Rodham, co-head of the Linklaters' financial sponsors practice.

Once the worst of the macro storm has passed, trade players are expected to return to deal-making in an environment where there will be cheaper assets to acquire. "Strategic buyers with a strong balance sheet are in a great position to take advantage of market dislocation, and if they are spending in dollars then their position is further enhanced," added Rodham.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds