Benelux Unquote

Meusinvest, Spinventure in €4m round for PDC Line Pharma

Round included €2.6m equity and €1.4m in bank loans, EU funding and French and Belgian regional funding

Karmijn Kapitaal leads €10m round for Five Degrees

Karmijn invested via its €90m vehicle Karmijn Kapitaal Fund II

Permira invests in Alter Domus

Alter Domus management will keep a controlling stake in the group after completion of the deal

EdRip takes majority stake in ACB Group

Arkéa Capital and Europe et Croissance exit the company fully as part of the deal

HIG Capital takes 49% stake in Ecore

Group was previously wholly owned by the family of CEO Guillaume Dauphin

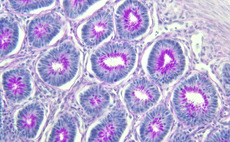

Mucap et al. in €10m Promethera series-C extension

Fresh capital will enable biotech company to invest in new product development

Luxembourg launches Reserved Alternative Investment Funds

New vehicles will increase flexibility and open up opportunities for private equity houses, real estate investors and hedge fund managers

Vendis Capital takes minority stake in Legio Group

Deal marks the fourth investment completed with the €180m Vendis Capital II fund

Chemelot leads €11m round for Fortimedix Surgical

Venture fund has been invested in the parent group of Fortimedix since 2004

Waterland takes majority stake in Scholt Energy Control

Transaction was supported by Investec acquisition finance

Equistone-backed Mademoiselle Desserts acquires Quality Pastries

Transaction marks the third bolt-on acquisition made with Equistone's backing

TDR's Euro Garages bolts on EFR

Transaction marks the first bolt-on for the business since the GP's investment

AKD appoints fourth partner to new Luxembourg office

Firm recently appointed Allard Schuering as senior corporate lawyer

CVC and Summit's Avast in $1.3bn deal for TA's AVG

Bolt-on is first major acquisition for Avast since being bought by CVC in 2014

Online food-ordering services feeding Benelux's IPO surge

GPs and VCs are capitalising on the improved climate for the public market exit route

VC-backed Takeaway.com floats with €993m market cap

IPO sees Prime Ventures and Macquarie among vendors of existing shares worth a total of €153m

Naxicap's House of HR acquires Human Capital Group

Naxicap first took a stake in the recruitment consulting group in 2012

IR partner Caroline Huyskes-van Doorne leaves Egeria

Huyskes-van Doorne joined the Dutch private equity firm as a fund director in 2003

Deal in Focus: Riverside acquires panel-door maker Epco

GP is planning an international expansion strategy for the panel manufacturer, with a particular focus on central and eastern Europe

Macquarie, Prime's Takeaway.com valued up to €1.1bn in IPO

The PE-backed company expects to raise €350m from public offering

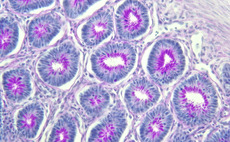

ACapital injects €850,000 into EpiGan

Renewable energy group has been backed by three funds since 2011

Riverside acquires European Panel Company

Investment will boost the group's consolidation in France and Benelux

Takeaway.com announces intention to float

Dutch company has been backed by Prime Ventures and Macquarie Capital over the last few years

Social Impact Ventures holds final close on €40m

VC had held second close on €30m in April, with commitments from the European Investment Fund