Austria

DACH unquote" October 2012

Recent studies by Rhodium Group and A Capital have suggested that Chinese investors could be in the early stages of a global shopping spree, with direct investment into Europe tripling in 2011 to $10bn.

Creathor Venture III holds final closing

German VC Creathor Venture has held a final close for its third fund on €80m.

DACH unquote" September 2012

The DACH region’s turnaround market is historically lacklustre and more popular with family offices and private investors than with institutionally backed GPs.

DACH unquote" July/August 2012

The German government’s bid to switch the country to renewable energy has created a funding gap that needs filling.

DACH region turns a corner

DACH region turns a corner

DZ Equity Partner and WGZ merge PE operations

German GPs DZ Equity Partner and WGZ Initiativkapital have combined their private equity operations to become vR Equity Partners.

EQT buys UC4 from Carlyle

EQT has wholly acquired Austrian software company UC4 from the Carlyle Group.

Lead Equities-backed Weidinger acquires IP-Group

Lead Equities portfolio company Weidinger & Partner has acquired a majority stake in Austrian educational services provider IP-Group Beteiligungs GmbH.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

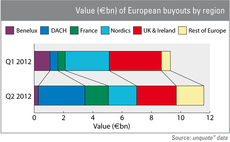

DACH buyout market outweighs neighbours in Q2

Buyouts in the German-speaking region have shown a significant gain in value from the first to the second quarter of 2012, enabling the region to top the regional aggregate value table.

DACH unquote" June 2012

Vienna’s stock exchange has experienced a few tough years, but new chief executive and several planned private equity IPOs over the next two years could see the bourse becoming attractive to private equity once again.

Vienna bourse set for IPO comeback

It has been a tough few years for Vienna’s stock exchange but an ambitious new CEO and several planned private equity IPOs over the next two years could see the bourse become attractive again to private equity. Carmen Reichman reports

DACH unquote" May 2012

Germany has recently reformed its insolvency law with the introduction of ESUG, the Act for Further Facilitation of the Reorganisation of Enterprises, which promises to make it easier for businesses to get out of administration and back on their feet....

Invest AG set to buy Philips' Speech Processing unit

Invest AG, the private equity arm of Raiffeisen Banking Group Upper Austria, has agreed to buy Philips' Speech Processing unit.

Law firm e|n|w|c in merger with Taylor Wessing

Austrian law firm e|n|w|c has merged with international counterpart Taylor Wessing.

Balderton seeds Archify

Balderton Capital has completed a seed investment in Austrian technology company Archify.

Deutsche unquote" April 2012

Driven by the numerous crises of recent years, the regulatory landscape of Europe is changing, with a strong political debate taking place in Germany. Over the past decade, Germany has consistently been the third-strongest market for European private...

Schmirl joins GMP Mezzanine-Partner

Gamma capital partners has hired a new partner, capital markets expert Manfred Schmirl, who has joined Gamma MezzoPreneurs’ industry network, GMP Mezzanine-Partner.

Deutsche unquote" March 2012

As 2012 ticked over, Germany was predominantly making headlines with its positive economic data and Angela Merkel’s leadership role in the EU.

Zurmont Madison acquires majority stake in AKAtech

Zurmont Madison Private Equity has acquired a 55% stake in Austrian electromechanical assembly and manufacture firm AKAtech Produktions.

gamma capital partners portfolio company expands to Austria

gamma capital partners' icomasoft AG has established opvizor GmbH as its Austrian business outlet.

Deutsche unquote" February 2012

While the rest of Europe has suffered from a low deal volume in 2011, the DACH early-stage sector is going strong. Considering the well-established venture scene, it is not surprising that this region has dominated early-stage in Q4 2011.

Constellation to manage Greenpark Capital portfolio

London-based buyout firm Greenpark Capital has appointed Constellation Capital AG to manage one of its private equity portfolios in the DACH region.

Constellation acquires Ibis Acam

Switzerland-based private equity firm Constellation Capital AG has acquired a majority stake in Vienna-based education provider Ibis Acam Group.