Belgium

Elaia, BPI France in €21m series-C for iBanFirst

Fresh capital will be used to expand the company's financial services platform

Hg leads $30m series-B for Silverfin

Existing shareholders Pieterjan Bouten and Louis Jonckheere will leave the company

Avista buys 50% stake in Vista Healthcare

Consumer health company is valued at €305m, making it the largest buyout deal in Belgium in 2020

Vortex acquires mortgage broker Hypotheek.winkel

Company's founders will retain a minority stake in the business

Callista Private Equity carves out ArcelorMittal Ringmill

GP focuses on special situations and generally invests in companies with negative EBIT margins

Gimv confirms dividend but reports negative portfolio return

Gimv invested €205m in six new platform investments and additional bolt-ons in 2019/2020

Gilde buys Corilus from AAC Capital

Sale for the healthcare software company began in November 2019 and continued in spite of coronavirus

Levine Leichtman backs SIPM MBO

Previous investor Fin.Co sells its majority stake in the company following its investment in 2017

Omers leads €16.25m series-B for Deliverect

Omers Ventures managing partner Jambu Palaniappan will join the Deliverect board

MVM invests $14m in MDxHealth

MVM is drawing equity from MVM Fund V, which held a first close on £150m in November 2018

Fortino Capital Partners holds first close on third fund

LPs backing the €45m first close comprise existing investors following the launch in Q1 2020

Consortium backs $112.5m round for Collibra

Data software company was valued at $1bn post money in its 2019 round and is now valued at $2.3bn

Carlyle buys stake in Mak-System

Belgium-based blood chain management software company draws investment from two Carlyle vehicles

KKR-backed Gamma takes stake in Univercells subsidiary

KKR's $50m investment in Univercells will be drawn from its Health Care Strategic Growth Fund

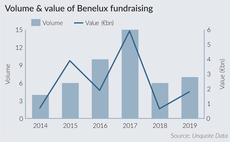

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

M80 acquires Spantech

M80 Capital I looks to provide equity tickets of тЌ10-40m to companies in Benelux and France

VCs in €20m series-B for PDCLine

In 2016, Belgian VC Meusinvest, Spinventure and several business angels invested €4m in the company

PAI Partners to launch €600m mid-market fund

Vehicle will target companies based across Italy, Spain, Germany, France and the Benelux region

Vendis appoints Riisberg as senior adviser in Nordic region

Christian Riisberg was previously founding partner of Alipes and a board member for various companies

IK exits CID Lines to trade

Livestock hygiene specialist was reportedly expected to fetch a price tag of more than €300m

GHO Capital buys Ardena from Mentha

Mentha created Ardena by merging three portfolio companies in 2017 and conducting bolt-ons

SmartFin closes sophomore fund on €240m

Belgian early-stage and growth fund will provide €500,000-12m equity tickets

Volta collects €35m for Volta Ventures II

New vehicle will provide funding to Benelux-based software and internet startups